What is DeFi 2.0?

Description

DeFi 2.0 is a new generation of blockchain applications with efficient use of capital, liquidity stabilization mechanisms, and better user incentives.

What is DeFi 2.0 in crypto economics?

Have you ever heard of the term DeFi 2.0? It's one of the latest trends to improve decentralized finance by removing the technological and user limitations of the existing DeFi 1.0 model. It is provided by improving DeFi services for all participants in the crypto ecosystem. It is a revolutionary approach that addresses the current shortcomings in decentralized finance of the first wave of development. You can compare, for example, the emergence of Bitcoin (this is DeFi 1.0) and Ethereum with the option of smart contracts (this is DeFi 2.0) or as new, more scalable, and faster blockchains (like Solana, BSC, and TRON).

What else is the answer to the question: DeFi 2 what is it? It is a series of updated services aimed at solving a multitude of problems, from centralization, security, speed, and scalability, to the fragmentation of crypto market liquidity.

For example, DeFi2.0 protocols now provide insurance for liquidity providers to prevent periodic losses. This positively impacts DeFi's reputation and attracts additional investment and users, which ultimately reflects positively on the entire market for crypto projects in India.

Decentralized finance services 2.0 meets new regulatory requirements (Know Your Customer and Anti-Money Laundering Checks). An example of a potential improvement DeFi 2.0 could bring is insurance against recurring losses, a risk liquidity providers in the DeFi 10 sector have to deal with very often. This solution could attract more investors and benefit all customers, stakeholders, and the entire world of DeFi's decentralized services.

The history of DeFi 2.0 platforms began 2 years ago. That's when the term DeFi 2.0 became ubiquitous. It is safe to say that one of the first projects that realized the evolution was the Olympus DAO platform (on the Ethereum blockchain network). It has its reserve fund and decentralized finance coins are used to fill the fund after the sale.

Also, early 2.0 projects include Abracadabra Money (SPELL). It now runs on a variety of blockchains, including BNB Smart Chain. The protocol converts cryptocurrencies into Stablecoin Magic. There are other DeFi 2.0 representatives in the cryptocurrency market. Their number is growing, as are the topics devoted to such platforms.

By the way, Binance smart analysis shows that the number of new developments in this network is constantly growing, and this blockchain is becoming one of the in-demand for DeFi startups to deploy.

Nevertheless, DeFi 2.0 faces several limitations specific to cryptocurrencies. These include limited scalability, the need for high-quality oracles and data provider accuracy, security risks due to users' lack of understanding of the technology, and liquidity constraints that reduce the effectiveness of the capital application.

It is also worth noting that security risks are still a concern for many users despite security audits and the regularly changing nature of decentralized finance services updates.

What are the limitations of DeFi 2.0 for users and projects?

The DeFi 2.0 decentralized finance industry has several limitations that need to be overcome shortly. We can say that these are common problems that have formed in all blockchain-based products.

The first and most acute is scalability: any decentralized finance service built on a blockchain network, where there is a lot of traffic and stakes, can be slow, and a lot of finance must be spent on it. Accordingly, simple tasks will require significant time and money resources.

The second problem is supplying quality and accurate data. Third-party contractors and oracles usually perform this function. For services, which depend on external factors, the requirement for accurate information about the state of the market from third-party sources is one of the conditions for normal functioning.

Centralization of management and key decision-making: Although DeFi is becoming increasingly decentralized, many platforms still don't practice the proper management principles and allocation of responsibilities inherent in DAO.

Security: Many customers don't fully understand the risks associated with DeFi and place their funds in smart contracts without knowing if they are safe. Although security audits are performed, they become less effective over time when updates are released. In addition, it's not uncommon for development teams to not release updates at all because they either don't have the resources to do so or they think their projects are already secure.

Liquidity: the main problem in this area is the liquidity gap. This happens because of the different placement of liquidity pools and markets between blockchains and platforms. Often, assets placed in a liquidity pool are not used in other projects, resulting in a lower return on capital.

What are the options for using DeFi 2.0 in the overall scheme of the crypto industry?

DeFi2.0 is offering more than just another service. It is a sought-after service that helps, among other things, the development of blockchains themselves that support smart contracts, including Ethereum, Stellar, Binance Smart Chain, TRON, Solana, and others.

What are some examples of DeFi 2.0 applications already in place?

Unlocking the value of stabilization funds: In decentralized finance services 1.0, betting on LP tokens with a yield farm was the main way to multiply profits. However, DeFi 2.0 goes further, using these LP tokens as collateral for various opportunities, such as cryptocurrency lending and token mining, and continuing to make profits for Indian residents.

Mandatory insurance for smart contracts: since verification of smart contracts requires significant financial and human resources, this has not always been implemented by DeFi1 projects. Decentralized finance services 2.0 is more adaptable in this regard and allows investors to own insurance for a specific smart contract, such as a yield optimizer, to reduce the risk of losing their deposits.

Insurance against volatile losses: Liquidity mining sometimes results in volatile losses when the value ratio of two assets changes, causing financial losses. DeFi 2.0 protocols now offer ways to mitigate risk, particularly insurance funds that are formed based on the fees received from one-way LPs.

**Self-loans: **this is a unique offering of the loan system to prevent liquidation risk.

Who controls DeFi 2.0?

The question of who controls decentralized finance is often asked in specialized forums. Regulation and control are not centralized in any area of the crypto industry. Some jurisdictions, for example, have already decided on governance standards, but for the most part, there is no unified concept yet.

But how is the decentralized finance industry controlled? Of course, it is controlled by the crypto investor community itself and the transparency of blockchain transactions.

First, a concept like Decentralized Autonomous Organization (DAO) has emerged. It is an organizational governance model in which the community decides the main development issues through democratic voting. Once upon a time, MakerDAO introduced this standard by offering its community the right to vote. This solution seemed organic and accurate to everyone, and many services have followed suit, allowing their users to vote and manage the decisions of the protocol.

Blockchain also works as an open ledger where all changes and updates can be spied on. This allows the community to control funds in the public wallets of services and exchanges.

Regulators are also showing an increased interest in the DeFi industry, and all companies and startups in the decentralized finance sector should consider this. Consultations are conducted, analytics are collected, and consumer interest is researched. All of these factors also influence the formation of laws to regulate the crypto economy sector.

What are the risks of DeFi 2.0, and how can they be prevented?

Unfortunately, we have to state that DeFi 2.0 has inherited many risks that were typical for decentralized financial services 1.0. You need to be aware of these risks and take appropriate precautions:

-

Smart contracts can be hacked. Very often, DeFi projects are targets for this type of fraud. Many market examples are imperfect, and a competent hacker will always exploit a vulnerability.

-

An audit helps to combat hacks. This is an audit of algorithms and technical data of smart contracts. There are two types: external and internal. External audits are conducted by specialized audit companies (e.g., CertiK, Consensys Diligence, Solidity.finance). Internal audits are conducted by the team itself.

-

Even if a project is audited, it is not guaranteed to be safe. To mitigate this risk, you should conduct thorough research before investing in any project and remember that all investments involve some level of risk.

-

Changes in the law can also hurt investments. As indicated earlier, regulators in various countries are increasingly focusing on decentralized finance. Emerging laws and regulations could force many platforms to change their structure or stop operating altogether. In general, cryptocurrencies are becoming more and more interesting to regulators, and DeFi 2.0 projects are no exception.

The most important advantages of DeFi 2.0 as an improved form of decentralized finance

The development brings something new and interesting to an existing service. These are undeniable advantages for which newer forms are preferred. For example, DeFi 2.0 also has several pluses, which are as follows:

-

Providing much more security for projects (more attention is paid to technical security, and possible bugs and problems are investigated in advance);

-

Helping to master new blockchain platforms (a new type of decentralized finance is also new, more profitable ways to earn money, available to every user);

-

Attracting new audiences and investors;

-

Forming an insurance market for decentralized financing.

Top 5 largest DeFi 2.0 projects

DeFi has a market capitalization of $45,511,664,391. That's not a record. In the bull market 2021 in November, the market value of all crypto projects in this area reached $172 billion.

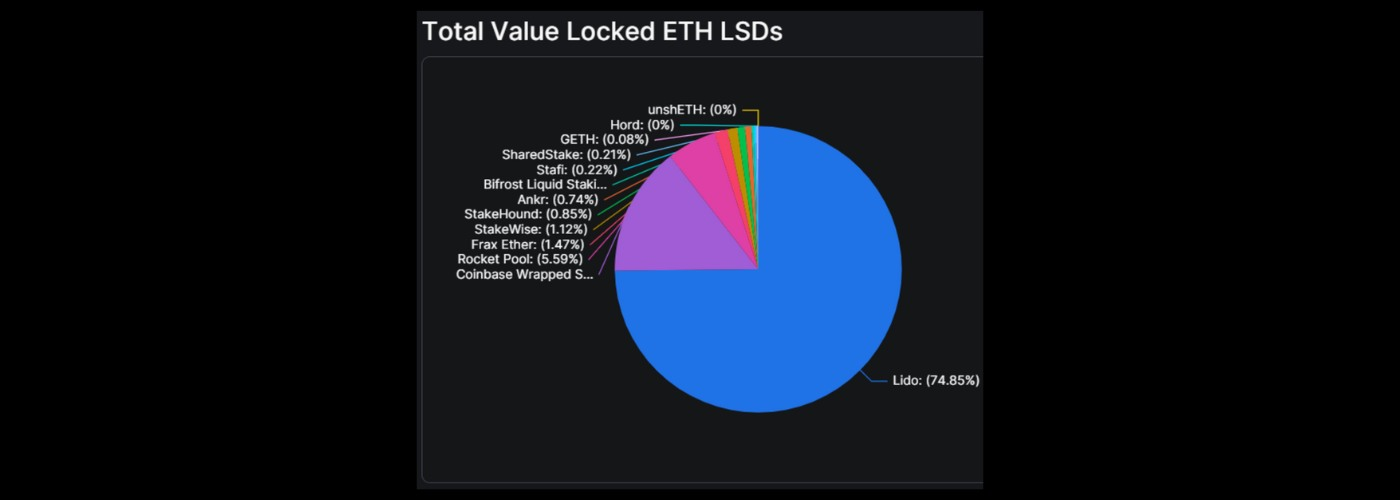

The absolute market leader is the Lido Finance project. More than $8.8 billion in capital is locked up in TVL (Total Value Locked). The project accounts for 74.85% of the entire decentralized finance market.

In second place is Coinbase Wrapped StakedETH. Over $1.7 billion in locked value and 14.63% of the total market. In third place is Rocket Pool, with $657.94 million in locked value and a 5.5% market share.

Frax Ether and StakeWise with 1.47% and 1.12% market shares.

A more visual representation of the projects' share of the entire market is shown in the chart below.

FAQ

How safe is DeFi 2.0?

Security is the main advantage of the new decentralized finance form. Market growth since 2020 in DeFi has been deafening, so security has become second nature for many projects. However, at the time when the boom of the first successes passed, the obvious disadvantages became apparent. So new projects in the crypto industry think about security first and then the brightness of service or marketing. Security has become the mandatory standard for DeFi 2.0.

When did DeFi 1.0 move into the new DeFi 2.0 development stage?

Today, there is no clear boundary for transitioning from one form of decentralized finance to another. It didn't happen overnight, either. Instead, the baggage of problems in the first projects accumulated, and the solution was a complete renewal of the DeFi form.

Historically, it is possible to draw a line between two stages: from summer 2020 to the end of 2021 is the first stage in the development of decentralized finance. Characterized by a significant number of new projects, a boom in DeFi growth on Ethereum, and accumulated problems with security, scaling, speed, and the high cost of transactions.

The second stage conditionally began at the end of 2021 and lasts until then. It is characterized by various blockchains in use, a reduction in the concentration of projects on the Ethereum network, and increased security standards and open processes.

Why do we need DeFi 2.0?

Decentralized finance has brought a lot to the crypto industry. Most importantly, they have played a key role in developing passive income from investing and expanded the availability of funds in the digital sector. This was when services such as credit and deposits were unavailable to the average user. Therefore, the industry can no longer do without this type of service. The new stage of development has only made it healthier, more honest, and safer for customers in Mumbai, Delhi, Agra, Hyderabad, or Calcutta.

What are the services included in DeFi 2.0?

Decentralized finance seeks to Decentralized finance aims to offer maximum services for passive and active earning. Major services include: DEX Exchanges, Liquid Staking, Lending, Derivatives, Yield Aggregator, Algo-Stables, NFT Lending, Leveraged Farming, Staking, Options Vault, and more. As you can see, most services duplicate classic financial instruments in fiat. But there are also unique earning opportunities available only in cryptocurrency.

Conclusion

To understand second-generation decentralized finance, one must have at least minimal knowledge of blockchain and cryptocurrencies.

But it is worth noting that the DeFi 2.0 sector may well be for those owners of cryptocurrency assets who have been in the market for a long time. Nevertheless, its goal is to present even more income opportunities, make it easier to sell and buy assets and remove the barrier to entry into the industry. DeFi 2.0 is important because it aims to democratize the financial sector while maintaining safety standards and can benefit all participants.

In addition, the analysis of DeFi 2.0 suggests that they are becoming an important milestone for the entire decentralized finance industry. During 2022, interest in decentralized finance increased sharply against the background of increased regulation of centralized exchanges by the SEC and other Indian regulatory authorities.

At the same time, the sector of decentralized finance services has a long way to go to get rid of the 1.0 form's shortcomings to become more attractive to investment funds and companies.

Nevertheless, DeFi 2.0 has already proven its viability and value for the cryptocurrency market, and accordingly, we should expect the emergence of interesting and promising decentralized finance startups and applications in the short to medium term.

And how DeFi 2 can impact the entire cryptocurrency market? We can predict that decentralized finance services 2.0 will make it more secure and valuable for the growing cryptocurrency community very shortly.

DeFi 2.0: what is it? It is also an interesting stage in the transformation of the entire crypto and blockchain market, a response to the challenges posed to it by both regulators in leading countries and the classical financial bureaucracy trying to maintain its influence to the same extent.