Crypto regulation: legislation and world practice

Description

Crypto regulation is one of the hottest issues on the legislative agenda in different countries. Approaches to law vary. However, one thing is clear: cryptocurrencies have left no country in the world indifferent.

The cryptocurrency market is a new type of financial relations that appeared outside countries' regulatory frameworks, being a superstructure over the classical financial world of fiat currencies. Due to the novelty of assets, lack of precedents, and centralized management, cryptocurrencies have been out of the official field of laws and regulations for quite a long time. However, the more the market grew, the broader and more active the development of regulatory norms available to different countries. Now, the regulation of cryptocurrencies is one of the important articles of discussion by most legislative bodies of other countries.

Regulation of cryptocurrencies in world practice

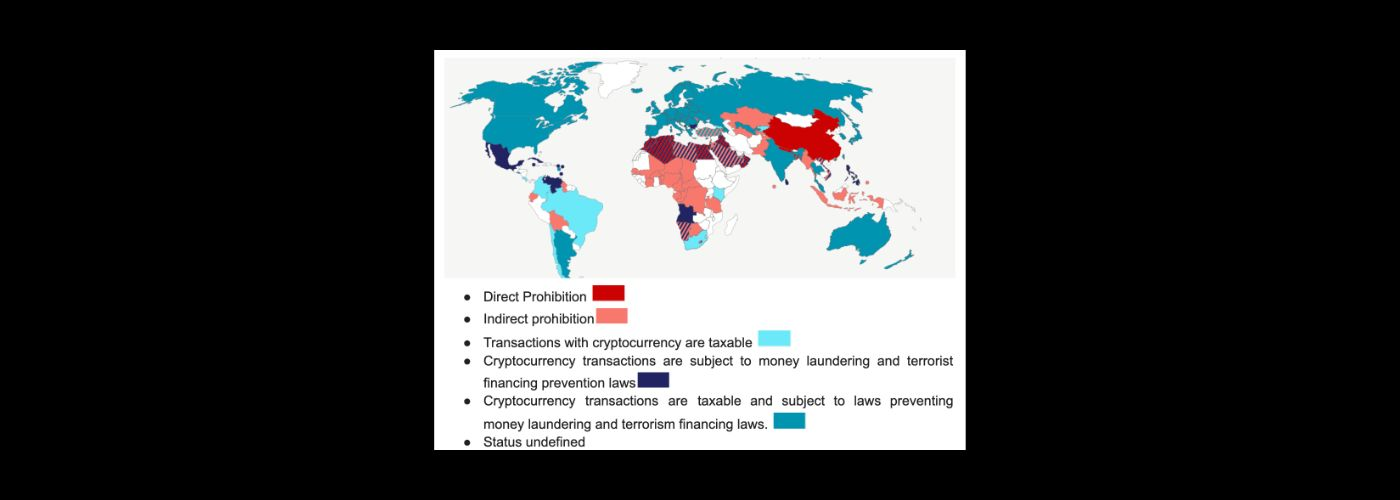

There is no single standard for cryptocurrencies. Each country chooses its path of development and norms of regulatory pressure on the crypto market. This process has only just begun to emerge, and countries are just starting to explore it. Today, there are several areas in which crypto regulators work. Cryptocurrency regulation in the world (data as of November 2021):

Countries with a direct ban on cryptocurrency

This strategy involves banning the circulation and use of cryptocurrencies in the country, accepting assets as illegal, and prosecuting the spread of cryptocurrency use.

China is a prime example of such a country. In September 2021, the government of this country signed a complete ban on mining and crypto transactions.

Cryptocurrency exchanges were forced to close their activities in China, and using cryptocurrencies in financial transactions became illegal.

Instead of private cryptocurrencies like Bitcoin, Ethereum, BNB, and others, the government has chosen to create its regulated digital currency of the central bank CBDC—the digital yuan.

Moderate regulation strategy

The strategy of moderate regulation of cryptocurrencies is the most common in the world and is followed by more countries. It consists of the fact that cryptocurrencies fit into the general financial system of the country: they are subject to taxation, reporting, legislation on combating illicit trafficking, sanctions restrictions, licensing of exchanges and trading applications, etc. Such countries include the United States, South Korea, the Russian Federation, Estonia, the European Union, and others.

USA

Cryptocurrency regulation in the U.S. entered an active development phase in 2022. By this point, the following general concepts of regulation have been identified:

- The regulators for cryptocurrencies are the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

- Providers of digital asset services, including cryptocurrency exchanges and non-swappable token platforms (NFT), must operate under the Bank Secrecy Act (BSA) and report suspicious user transactions.

- All income from cryptocurrencies is taxable and necessary for accounting purposes.

- Unregulated industry segments like transaction mixers and algorithmic unsecured Stablecoins are strictly prohibited.

- Cryptocurrencies received the status of securities with all the ensuing regulatory implications, and the first cryptocurrency, Bitcoin, is recognized as a commodity, as stated by the head of SEC, Garry Gensler.

Russian Federation

The Russian Federation has long resisted accepting cryptocurrencies into its official legal framework. However, in the last 2022, it also took a number of actions to determine the status of cryptocurrencies. Thus, private cryptocurrencies such as Bitcoin are prohibited in the country as a means of payment. At the same time, these assets are considered possible objects for participation in international settlements, and the parameters of regulation of cryptocurrency mining and the way of management of exchanges for trading the assets were introduced.

Estonia

Estonia was one of the first countries to recognize the status of crypto. It happened back in 2017. All exchanges and digital currency services must undergo the licensing process with the Estonian Police and Border Guard Board as a" Virtual Currency Exchange Service Provider for fiat money."

South Korea

South Korea's cryptocurrency inverters have a dynamic legal environment, constantly being supplemented and changed. For example, the authorities passed a law on the taxation of income from cryptocurrencies, which will take effect in 2025. All cryptocurrency exchanges must undergo a compulsory licensing process, and the country's officials are required to declare their cryptocurrency. There is a ban on anonymous cryptocurrencies like Monero and Zcash. The country is also working on the issue of legislative approval of the status of blockchain, Metaverse, NFT, and other crypto industry objects.

Countries that have adopted cryptocurrencies

These are the countries where cryptocurrency circulation is officially accepted and has equal legal status with other currencies. El Salvador remains the absolute leader in this segment.

The country has adopted Bitcoin as its official currency, equal in circulation to the U.S. dollar. The policy of cryptocurrency regulation encourages the use of BTC by the general public and businesses. At the state level, there are programs for education in the field of cryptocurrencies, industry support, and the distribution of environmentally friendly Bitcoin mining.

The Philippine government intends to clarify the taxation of cryptocurrencies by 2024 as part of an infrastructure bill. Department of the Treasury presented President Ferdinand Marcos Jr. and his administration with a plan for fiscal consolidation and resource mobilization for the Philippines.

In addition, the government began to pay special attention to games on the principle of "play and earn" (Play-to-Earn, P2E). An Internal Revenue Service directive states that users must report their earnings from games like Axie Infinity. The P2E industry has not gone unnoticed by the Anti-Money Laundering Commission (AMLC) of the Philippines and the Securities and Exchange Commission (SEC) of the Philippines. Previously, the SEC called on banks and financial institutions of Manila, Davao City, Cebu City, and other big cities to monitor suspicious transactions related to Axie Infinity and similar games that traders can use to make money.

Conclusion

As you can see, many countries are still on the way to establishing a clear regulatory framework and legislative approval of cryptocurrencies. Today, we can say that cryptocurrencies have not left any country indifferent, and most of them are trying to define their status in their legal field to use them in circulation.