Token, Coin, Stablecoin, Altcoin - What Is It And What Are The Differences?

Description

What is an altcoin, coin, token, or stablecoin? In this article, we will talk about the main difference between them.

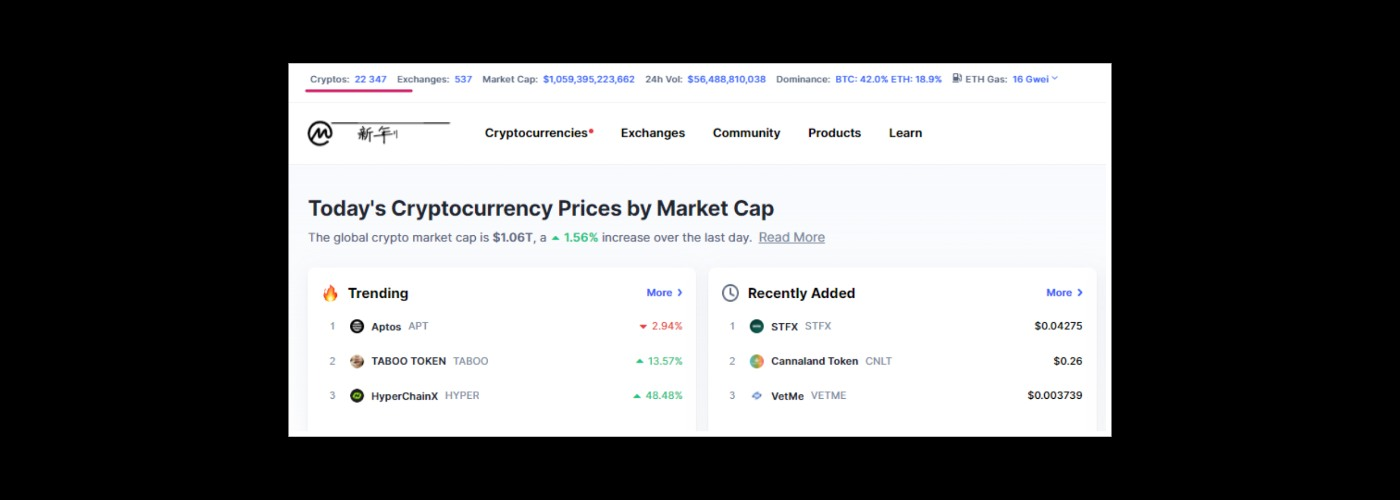

The cryptocurrency industry is very diverse. Since 2008, when Satoshi Nakamoto introduced the world's first cryptocurrency, Bitcoin Electronic Cash System, the number of new projects has been in the tens of thousands. As of 2023 alone, more than 22,000 are officially listed in the Coinmarketcap cryptocurrency ranking. And the number is increasing every day. It's easy to get lost in this diversity. In this case, for many people, it remains a mystery: how to distinguish between token, coin, stablecoin, and altcoin. We offer to define this topic.

What is an altcoin definition?

Bitcoin is the first cryptocurrency based on blockchain technology. It is the gold of the crypto industry and the pro-parent of all other projects. All the cryptocurrencies launched after BTC are alternative or altcoins (from the words alternative and coin). Therefore, the definition of altcoin may sound like this – all cryptocurrencies exist in the digital asset market, except Bitcoin.

So, what are altcoins? What's altcoin's meaning and history? Let's check the altcoin definition. Altcoins can either take the form of an entirely new digital currency project or can leverage the open-source nature of other initiatives to achieve different goals. Specifically, altcoins basics can introduce different monetary policies that encourage different use cases or treatments such as by introducing minimum spends, positive or negative interest on holdings, or even changing stances on mining – the way through which new cryptocurrencies enter a financial system. For almost three years (from 2008 to 2011), the entire cryptocurrency market was represented only by Bitcoin. But in 2011, the first altcoin appeared – NMC (Namecoin). It's to be tied to the digital domain name distribution project. The most common buying and selling altcoin is the second largest cryptocurrency – Ethereum.

What are altcoins for today's market? The same as always: solving the technological and technical problems of the industry. Initially, the emergence of the bitcoin vs. altcoin struggle came from the imperfection of the first cryptocurrency. The developers saw a need for more modern and affordable solutions. It was understood that Bitcoin was only sometimes convenient for the company's economy. That's why altcoins appeared. They solve several difficult problems at once, which are not yet available for Bitcoin:

- Creating a project economy on automated contracts (smart contracts);

- reducing the cost of expensive PoW mining;

- improving the scaling and speed of transactions between wallets;

- increasing the level of anonymity on the network;

- Bitcoin's limited functionality;

- expansion of financial censorship within the international political system in the Philippines;

- the development of every Philippine region in the crypto industry.

What is a token? Examples of popular tokens

The backbone of all participants in the crypto industry is the blockchain. Without this unique, stored, immutable feature, it is impossible to create a popular product, which today has become a full-fledged financial ecosystem with a trillion-dollar capitalization. In a general sense, a token is a digital certificate that is fixed in a blockchain and cannot be changed. However, another difference is important for a token. It is the absence of a blockchain of its own. Tokens are commonly referred to as currencies that are developed on a third-party blockchain. These are the most stable coins, tokens of DeFi projects, DAOs, and exchanges.

For example, Tether (USDT), Polygon (MATIC), Dai (DAI), Uniswap (UNI), and Wrapped Bitcoin (WBTC) are considered tokens. These are all tokens as they are created on the third-party blockchain technology of the Ethereum cryptocurrency in history. If we consider tokens vs. altcoins, we can say that tokens are part of altcoins.

The token meaning for the whole cryptocurrency market is great. Tokens serve an important function – the accessibility of digitalization for all people, companies, and nations.

Let's say you wanted to release your cryptocurrency. To do that, you would have to hire a big team and incur the large time and financial costs to develop the blockchain.

Using a token allows you to do away with these costs and provide any project with its token. Even a person with no technical background can issue their token.

What is a coin? What is the difference between a coin and a token?

Coin or cryptocurrency is a type of digital asset created on its blockchain. Unlike tokens, which are an adaptation of a third-party blockchain to each project's standards, a coin is an independent blockchain coin. Examples are cryptocurrencies of well-known blockchain networks Ethereum and the Ethereum blockchain coin (ETH), TRON and the TRON coin (TRX), Binance Smart Chain, and the BNB coin.

These are labor-intensive projects that provide not only the tokenization of a company's business but also the creation of a cryptocurrency ecosystem as a whole, together with all the facilities: exchanges, wallets, transaction analyzers, and other necessary facilities.

What is a stablecoin? What are stablecoins' popular types, and what are the rates?

A stablecoin is a coin whose exchange rate is subject to minimal price changes and must always remain constant. A stablecoin is often pegged to some fiat currency, a basket of cryptocurrencies. Less often, stablecoins are backed by tangible assets like gold, silver, a basket of minerals, etc.

The main reason for the emergence of stablecoins is the need to use an asset with a constant exchange rate when dealing with volatile cryptocurrencies. This facilitates digital accounting and calculation of the value of a particular asset on a cryptocurrency exchange at a moment's notice. The most popular type of stablecoins are coins pegged to fiat currencies. For example, to the U.S. dollar or euro. The exchange rate is taken as 1 dollar or 1 euro, and it makes using stablecoin very affordable. So, USDT is the most stable crypto, and stablecoins value everything crypto shrinks a few times.

Stablecoins are a relatively new type of cryptocurrency market participant, and each of them has its specifics, liquidity, risks, and degree of distribution. Today, many stablecoins have a total market capitalization of over $137 billion. The best stablecoins are Tether (USDC), USDC, Binance USD (BUSD), DAI, TrueUSD, USDD, Pax Dollar, and others. The most stable crypto and, at the same time, the largest stablecoin is Tether (USDT). USDT has a market capitalization of $66,916,184,809. It is the most stable cryptocurrency and the most used stablecoin. This stablecoin interest rates is connected with USD.

For example, it is convenient for private investors in the Philippines to send value from one person to another from Manila to Davao. It can also be used as an electronic payment medium for the whole country, for example, in international or intergovernmental settlements in Antipolo, Quezon City, General Santos, or Bacolod.

What are the key differences between the types of digital assets - token, coin, and stablecoin?

The main difference between altcoins and stablecoins lies in their purpose and, thus, their functionality. Because altcoins are subject to extremes in price volatility, stablecoins are intended to provide some stability as a hedge. Note that stablecoins have a fixed amount of cash reserves. Let's look at examples of different types of digital assets created on the same Ethereum blockchain. For example, Ethereum (ETH) is the second largest cryptocurrency in the world. The central component of the Ethereum ecosystem. Many token altcoins are created on the blockchain, which is used by various projects. In addition to those mentioned above, Metaverse and NFT tokens The Sandbox SAND, Decentraland MANA, Axie Infinity AXS, ApeCoin APE, Stablecoin TrueUSD TUSD, Pax Dollar USDP, and many other company tokens that are not related to thematically.

No matter what part of the Philippines he or she is in, any person or company can choose an appropriate form of digital currency and create cryptocurrency or tokens.

Tips for beginners

The main tip in the topic of choosing a form of digital currency issuance is to focus on one's own needs. That is, each company or individual should prioritize for themselves the areas and purposes for which tokenization is used. Both tokens, cryptocurrencies, and altcoins have specific roles in the market, making the cryptocurrency industry complete and diverse.

Several factors influence the decision:

- what functionality will be presented with the cryptocurrency;

- what technical tasks are closed with the new service, what form of digital assets is better suited;

- what financial and labor costs the company is willing to incur;

- in what time frames the implementation of tokenization is set;

- whether there is competent personnel, and so on.

Conclusion

Each company evaluates the effectiveness of tokenization and decides for itself whether there is a need to create a blockchain and cryptocurrency or whether it is possible to use third-party developments and create tokens. For the cryptocurrency market as a whole, it does not matter which form is chosen. For those who buy altcoins (we hope the altcoin definition was clear), there might yet be a blockchain project that offers staggering returns to committed investors. USDT consider being the most stable cryptocurrency ever.

Most stable crypto, altcoin vs. crypto, and tokens are all elements of healthy industry development and important parts of the cryptocurrency ecosystem. And they all impact the overall result – the adoption of the digital economy on the blockchain and the proliferation of opportunities to use it.