Liquidity pools and their tokens: what they are, mechanism of work

Description

A liquidity pool is a conglomeration of virtual coins on a decentralized platform, with the help of which liquidity is created for trading transactions. Assets in liquidity pools are provided by platform clients and locked in smart contracts.

Users transfer funds to their accounts to trade on centralized crypto exchanges (CEX) and use trading terminals for transactions. At the same time, users' funds are controlled by exchanges. Groups of developers began to create decentralized platforms (DEX) to stop being dependent.

With DEX's help, it's also possible to carry out trade transactions without the participation of intermediary structures. Funds are under the control of the clients of such exchanges. But such exchanges had a problem—a lack of liquidity. To solve the liquidity problem, liquidity pools were created.

Liquidity pools and their tokens: what are they

In economic theory, a pool is an association of organizations in which the income goes into a common fund and, after that, is distributed between the participants according to previously established proportions.

In the cryptocurrency industry, a liquidity pool is a conglomeration of virtual coins on a decentralized platform, with the help of which liquidity is created for trading transactions.

Assets in liquidity pools are provided by platform clients (liquidity providers) and locked in smart contracts. Due to this, transactions in the pool itself are carried out automatically without intermediary structures.

Liquidity pool providers: who are they?

Those users who add liquidity to the pools by depositing their own tokens into the stack are called liquidity providers (LPs). Any user can become such a liquidity provider. Liquidity pools enable providers to contribute their own tokens to the pools, which in turn receive tokens of the platforms, including those proportional to their contribution to the liquidity.

Pool tokens accrue to users for contributing assets to the pools. It's a kind of receipt for providers to return deposited funds and the % received.

Tokens can be used to:

earn % on Yield farming returns; receive cryptocurrency loans; transfer ownership of liquidity in staking.

It's worth noting that liquidity tokens accrue only to providers! To get them, the provider needs to deposit liquidity using decentralized venues. It can be Uniswap, for example.

As a rule, the notation of the LP token specifies 2 assets deposited to the pool. For example, for depositing CAKE and BNB into the PancakeSwap liquidity pool, the provider receives a BEP-20 token called CAKE-BNB LP.

Mechanism of operation of liquidity pools

First, the liquidity provider forms a pool where two assets are placed for further exchange. He also specifies the initial exchange rate. After that, providers can add their own assets to it. The provider can count on commissions from the client's transactions with the pool as soon as it is done.

Because of each exchange in the pool, the exchange rate also changes. This mechanism is called Automatic Market Maker (AMM). During transactions, the volume of coins of the first asset increases, and the volume of the second decreases. Because of this, the exchange rate changes.

You can even say that the liquidity pool operates on the principle of crowdsourcing. That is, users can pledge tokens in a smart contract to provide liquidity to the decentralized finance (DeFi) platform. Each time a transaction is made in the pool, a certain portion of the commission is distributed (based on the pool's rules), proportional to the owner of the LP tokens.

After an LP withdraws its own assets from the pool, the system liquidates its LP tokens to stabilize the reward mechanism according to the new number of LP tokens held by the customer.

Liquidity pools operate automatically and address liquidity shortages by encouraging users to provide liquidity in exchange for a portion of the trading fees.

CEX Liquidity Pools

CEX (centralized crypto exchanges) liquidity pools are mechanisms that combine the liquidity of multiple trading pairs on the same exchange. They are a tool to improve exchange trading liquidity, reduce spreads and increase trading volumes.

Liquidity pools of centralized exchanges work as follows: CEX pools the liquidity of multiple trading pairs and provides it as one common pool. Thus, traders can trade any trading pairs within the pool using a common order book and get the best prices. There are a number of advantages to liquidity pools on exchanges like CEX.

First, they allow for better liquidity in exchange trading, resulting in lower spreads and higher trading volumes.

Second, they allow traders to trade any trading pairs, simplifying the trading process and increasing flexibility.

For example, the Binance exchange offers a program for liquidity providers on the spot trading section - Spot Liquidity Provider Program. It is designed for liquidity providers.

At the beginning of 2022, its terms were updated and now, qualification for market makers is based on maker turnover only. Providers who qualify for the exchange can receive reduced commissions and higher API limits.

Overall, CEX pools remain a popular tool for improving liquidity on cryptocurrency exchanges. They allow for higher trading volumes and lower spreads, which makes trading on the exchange more profitable for traders. In addition, many exchanges provide additional tools to improve liquidity, such as market-making and arbitrage bots, which help improve the quality of trading on the exchange.

However, traders should be careful when using liquidity pools, as they may be less secure and less transparent than trading on individual trading pairs.

What you need to do to become a liquidity provider

To become a liquidity provider, you need to provide several actions.

First, a site that supports liquidity pools is selected. Next, a liquidity pool with a particular currency pair is selected. The currencies must be in a cryptocurrency wallet.

After that, both assets are added to the pool at a 50/50 ratio. For example, if a client wants to invest $2,000 in an ETH/DOT pool pair, he must deposit $1,000 in ETH and $1,000 in DOT as well.

When the generated deposit expires, the user is rewarded for funding the liquidity pool in the amount set by the decentralized platform.

Liquidity pools are popular among investors because of certain advantages of this process.

What are the advantages of investing in a liquidity pool?

Investing in a liquidity pool is somewhat similar to a deposit in a bank. The investor needs to provide his asset to the platform and then receive a % of the profit for its use.

Due to smart contracts, the process is automatic, and the clients and the platform do not deviate from the conditions prescribed in the code.

The vast majority of venues allow you to contribute a small amount of coins to the pool. If investors wish, they can increase their income using compound interest – that is, reinvest the profits from mining liquidity and then get even more profits in the medium term.

At the same time, investing in a liquidity pool has certain risks.

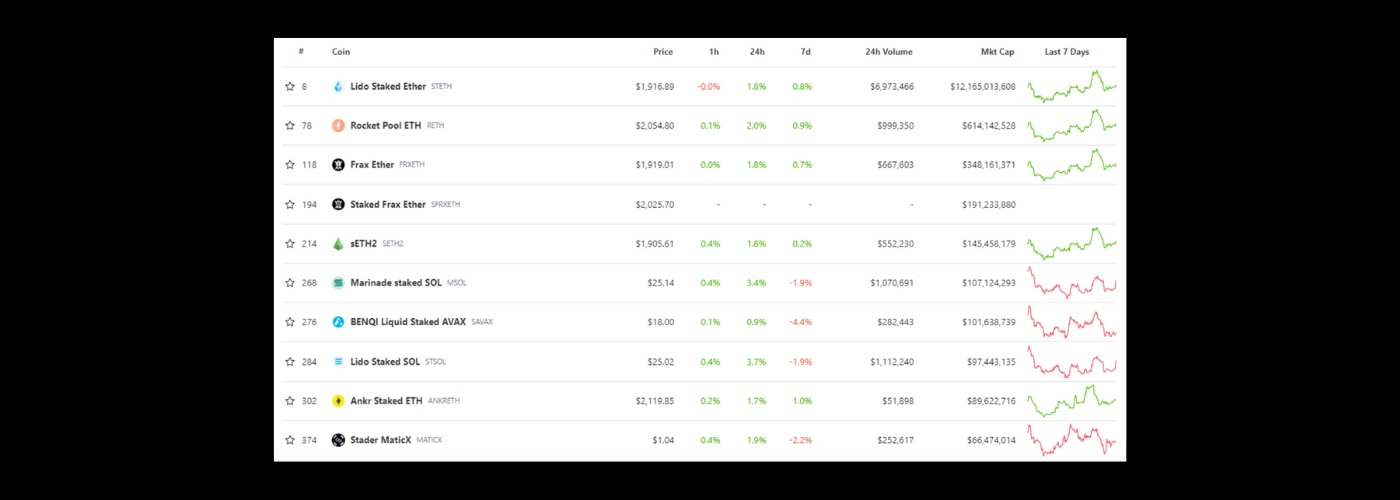

Liquid Staking Tokens Coins by Market

According to crypto market data provider CoinGecko, Liquid Staking Tokens Coins by Market Cap is $13,949,271,298. The top 10 tokens include Lido Staked Ether STETH, Rocket Pool ETH RETH, Frax Ether FRXETH, Staked Frax Ether SFRXETH, sETH2 SETH2, Marinade Staked SOL MSOL, BENQI Liquid Staked AVAX SAVAX, Lido Staked SOL STSOL, Ankr Staked ETH ANKRETH, Stader MaticX MATICX.

What are the risks of investing in a liquidity pool?

There is a risk of fickle losses, that is, due to the surges in cryptocurrency rates, there may be a decrease in the price of the investor's coins.

Also, if the platform does not have a clear trading strategy or its smart contracts contain errors and vulnerabilities, it is risky to lose all funds.

It is not uncommon for hackers to exploit vulnerabilities in smart contracts and steal user funds. Such hacks have become more common nowadays.

Nevertheless, despite the above disadvantages, liquidity pools interest investors greatly.

Liquidity pools for residents of the Philippines

For many crypto investors in the Philippines, the opportunity to make passive money from liquidity supply is one of the most sought-after. Especially in times of financial instability and global economic crisis.

For residents of a large country like the Philippines, passive income from liquidity supply is very necessary. It's one of the obvious advantages for the investor - no territorial attachment. Anyone from Cebu, Manila, Davao, Makati, and so on. It's a unique opportunity needed at this moment.

Conclusion

Thus, decentralized platforms offer users different tools to gain profit. Among them, there are liquidity pools. With their help, you can make a profit with minimal risk of losing money. It is possible to invest small amounts in the liquidity pool so they are available to the vast majority of users.