2021 - 2022 Crypto Market Outlook

Description

Future crypto predictions should be based on a balanced analysis of not only the asset itself but the entire cryptocurrency market and the overall economic agenda in the world. It's essential because then you can understand that this week in crypto is the best in the history crypto market, and the next one is better to be out of the way.

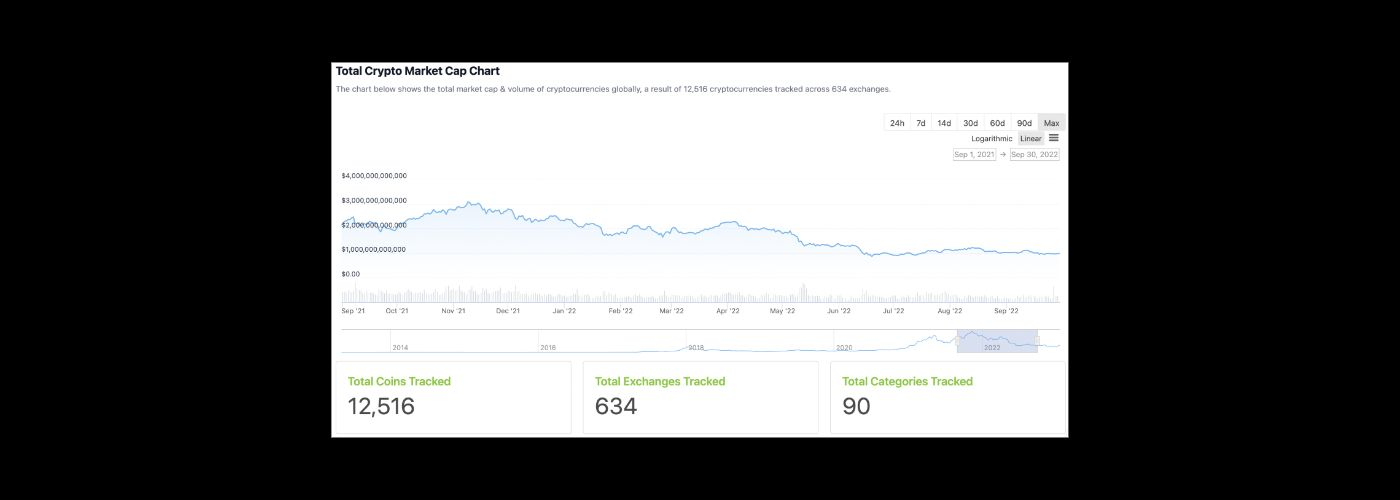

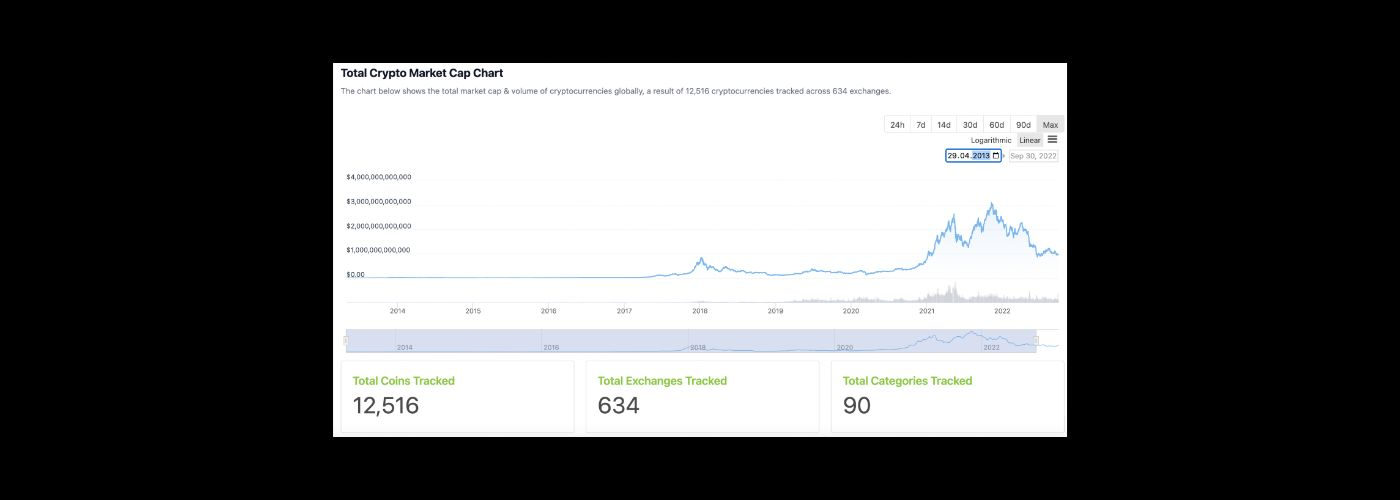

The cryptocurrency market continues to develop dynamically, despite the overall decline in exchange rates. Over the last year, the industry has experienced the whole range of changes imaginable, and this is quickly reflected in the cryptocurrency rates and market capitalization of all assets: the total value went down from a record $3.080 trillion as of November 9, 2022, to $859 billion as of June 2022.

Market overview 2022 for key cryptocurrencies

Indeed, the report to cryptos says that just a year ago, Bitcoin and the vast majority of altcoins renewed their record values thanks to the explosive growth of cryptocurrencies.

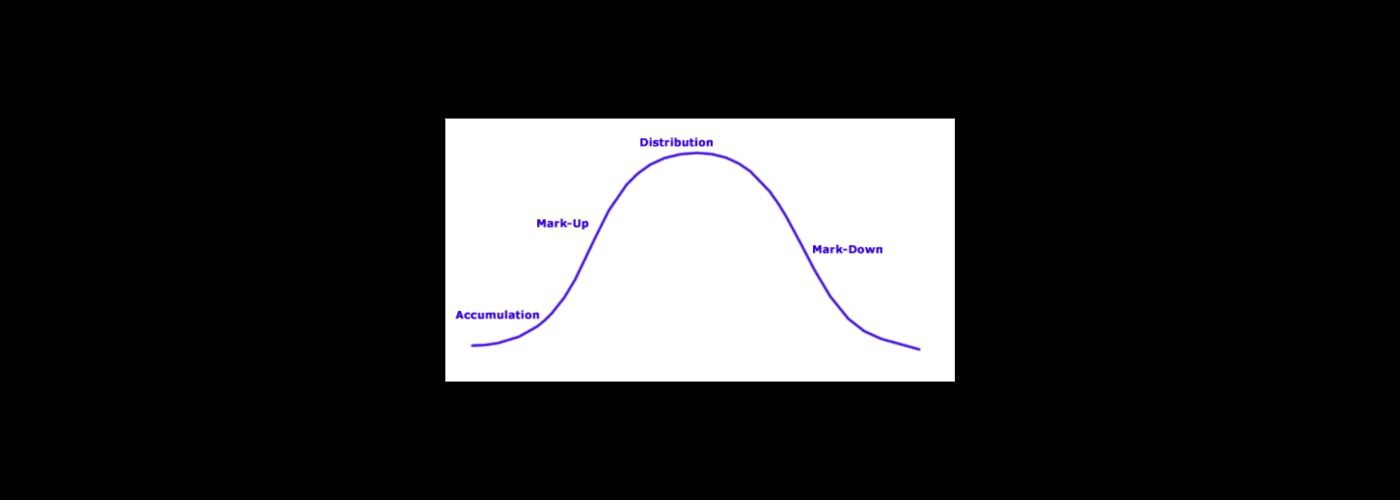

The entire crypto market is dynamic and consists of four development phases: accumulation, growth, peak, and decline. The 2022 period came during the descent and accumulation phase after an explosive rise in value at the end of 2021.

These cycles are mainly tied to the behavior of Bitcoin, the main cryptocurrency, and its dependence on halving (fee reduction), which is considered the starting point for the accumulation stage and the transition to the growth and peak stage. Let's see what the best months for cryptocurrency looked like and make 2022-2023 crypto predictions today based on this information.

Best months for cryptocurrency in 2022

So in the last year, the first cryptocurrency, Bitcoin, was able to set a price record of $69,990 per unit on November 10, 2021. The market capitalization at its highest point was $1.268 trillion. These figures closed the growth and peak cycle, followed by a sharp decline and a renewal of the minimum figures in the market. By mid-June 2022, the value of BTC had dropped to a record $17,600, and market capitalization was down to $355 billion, a drop of 74.75% from its peak value.

Most altcoins in 2022 are repeating Bitcoin's trajectory:

- Ethereum is down from $4,878.26 to $1,000, losing more than 80% of its value.

- BNB is down from $686.31 to $193.

- Solana was dropped to a low of $28 per unit after renewing its value to $259.96,

2022-2023 crypto predictions for popular cryptocurrencies in Thailand

Many analysts and representatives of large funds from Thailand who invested in Bitcoin are confident that the decline period is already over. It is supported by crypto predictions today, which were responsible for the beginning of accumulation and growth in past market cycles:

- The timing of Bitcoin's halving. The next block reward reduction should occur in late 2023 or early 2024. This point should be preceded by periods of refreshing minimum rate positions (which we have already seen) and accumulation between 320-380 days. According to the halving calendar, this accumulation period is just coming into effect.

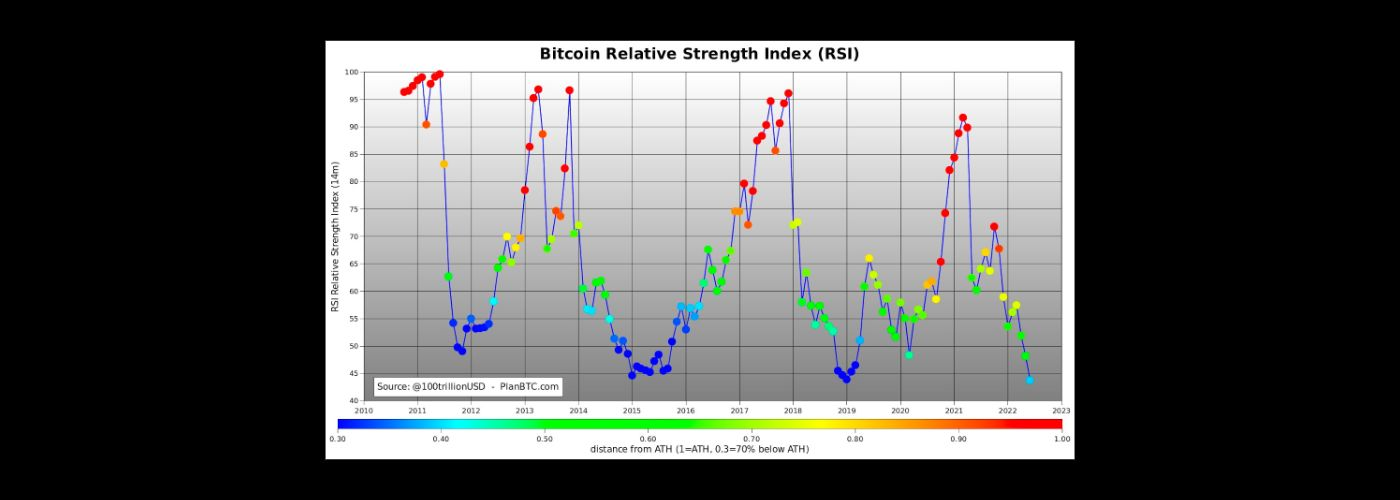

- Updating rate minimums. According to the Bitcoin Relative Strength Index RSI model, the cryptocurrency had time to update the minimum positions, which can also develop into a moderate recovery of rates.

However, it is impossible to say with a full guarantee that there will be no more Bitcoin decline. The reason for that is the tense geopolitical situation and recession of official economies caused by aggressive monetary stimulation policy during Covid-19 quarantine measures in Bangkok.

Ethereum

Regarding the Ethereum outlook: the stimulus or price deterrent here is implementing the roadmap to PoS and scaling the blockchain network. Since many dApps and DeFi services are built on the open-source Ethereum code, the positive implementation of these plans affects the overall cryptocurrency market as well.

BNB

BNB is tied to the success of the entire Binance ecosystem, of which the exchange is the largest entity. The interaction and development of this ecosystem translate into a rise or fall of BNB cryptocurrency.

Solana

Solana and the cryptocurrency SOL became one of the main competitors of Ethereum in the last bull cycle. It offered similar technological solutions to developers. If the team continues to develop at a similar pace and resolves issues with unscheduled blockchain suspensions - Solana could continue to grow.

Ripple (XRP)

The development of the cryptocurrency Ripple XRP at the end of 2022 depends entirely on the decision of the litigation between the issuing company Ripple and the SEC. A positive or negative decision will determine whether the cryptocurrency can remain in the top 10 of the world's strongest projects or lose its status.

Crypto outlook

Crypto outlook is a long process. The growth of cryptocurrency or its fall are not spontaneous events; they are influenced by a huge number of factors, both external and internal. In general, crypto trends in 2022 depend on the following:

-

The project's technical implementation and following its development strategy. If the crypto project follows its roadmap and makes no technical mistakes, it is safe to make a positive crypto outlook for Thailand investors.

-

Macroeconomic pressures and geopolitical environment. The cryptocurrency market continues to correlate with classic markets and react to changes in the value of a basket of fiat currencies, the S&P500 index, etc. Often, this market is even more volatile due to the pressure of this factor. If you want the answer to the question: will crypto go back up in 2022, you have to evaluate the changes in the whole economic situation (not only in Pattaya, or Phuket, or Bangkok), not just focus on cryptocurrencies.

-

Linking to a period. Historically, cryptocurrency volatility has been tied to a calendar period. So, the best months for cryptocurrency are December, November, and August. The worst are September, May, summer, and vacations.

Cryptocurrency news predictions: the role of the investor

Launching a digital cash system makes it possible to work and earn on cryptocurrencies. Bitcoin network has made a legal way to use cryptocurrency data to increase your wealth and earnings. And crypto has become one of the most popular ways to predict economic demand and the possibility of increasing the coin's value.

Future crypto predictions help many users of the crypto industry to benefit from the market situation.

It includes crypto trends 2022 analysis, crypto predictions today, and macro and micro economic factors of coin value changes. Professional analytics can answer investors' most common questions: will crypto go back up in 2022 and enable them to use the asset's trend reversal to their advantage?

Keeping track of Future crypto predictions allows you to track the general mood of the market, analyze and adjust your investment strategy and benefit from the exchange rate volatility. At the same time, the report to cryptos opens up opportunities to research market cycles (e.g., transitions to growth or decline, determining the best months for cryptocurrency, etc.) and use this data for analytical forecasts in the medium and long term.

Crypto outlook with the exchange EXEX

The growth of cryptocurrency is the best period for investors, with a big chance for profit and an active trading period. But EXEX experts are sure that not only pronounced bullish sentiment should be attractive. The cryptocurrency exchange presents its functionality, which is suitable for all stages of market development, not only for the stage of active growth.

Crypto outlook is an important part of a crypto investor's life; you just need to learn how to use this tool to make correct future crypto predictions.

This week in crypto showed no bad market—there are untapped opportunities. And with EXEX, all opportunities will sell.

Conclusion

In 2022 crypto predictions saved many investors because the whole year was in active decline, and expert analysis is just right here, for cryptocurrency news predictions are a natural state, as for a volatile asset. We like cryptocurrencies because there is no feeling of stagnation, standstill, or fading. The market is dynamic, hard to predict, and volatile.