Which way to go: CEX or DEX?

Description

What is a crypto exchange? It is standardly a place of storage, exchange, and additional earnings for numerous investors in digital assets. And it's also a community, a real phenomenon for like-minded people and market activists who share experiences, learn, and argue about market development issues. And one of the hottest issues in the community is the dispute: which centralized or decentralized exchange is better. Which exchange should an investor use? We will try to answer this question as well.

Centralized cryptocurrency exchange

CEX definition

CEX (Centralized Exchange) is a specialized platform that provides users with the service of exchanging, trading, and passive earning in cryptocurrency through a personal account and registration. The principle of CEX is simple: the user trusts the authority of the exchange and uses its service. And the exchange, in turn, stores users' cryptocurrency in separate exchange wallets and provides access to the wallet through the user's personal account.

This is one of the main differences between centralized and decentralized crypto exchanges.

How centralized exchanges work

Exchanges provide access to their service through an application or website. Each new user must pass the simple registration (enter your name and surname and link your phone or e-mail to the account).

The second step after registration is user verification. This is a documentary confirmation of the validity of the data. The platform may ask you to provide a photo ID, bank statement, to take your photo as proof of identity, etc. There are different variations on the documents and terms of verification. It all depends on the choice of the platform itself and the rules of internal regulation of the crypto sector in the user's country.

Verification performs several important functions for CEX:

- Enforcing Know Your Customer (KYC) and Anti-Money Laundering (AML) rules.

This set of international agreements calls on cryptocurrency exchanges to maintain transparency and market purity.

- It creates a link between a customer's account and an exchange's wallet.

A cryptocurrency investor does not have access to a wallet on the exchange but only gets access to it. Verification provides a logical entry and distribution of rights to assets.

- It opens access to an expanded number of services.

Many centralized crypto exchanges restrict non-verified users. They cannot access some services or have a reduced level of deposit and withdrawal.

The principle of CEX will be clear, especially to investors who have traded in the Forex or stock markets. The exchange offers primarily exchange and trading in cryptocurrency. All transactions are reflected in the order book. It is possible to see all buy and sell transactions online. Many platforms offer financial leverage tools and leverage. For example, the EXEX exchange has one of the highest rates for trading with leverage: up to X500 per trade.

The exchange earnings are derived from the commissions from each transaction. The amount of commissions is set individually by each platform.

Popular services on centralized crypto exchanges (CEX)

The most common services on CEX exchanges include:

- Buying cryptocurrency through fiat gateways and bank cards;

- Spot trading, leveraged margin trading, P2P trading, trading with the help of trading bots;

- Futures and options derivatives trading;

- Liquidity Farming and DeFi Stacking;

- Launchpad and presales;

- NFT trading;

- Copy trading, and so on.

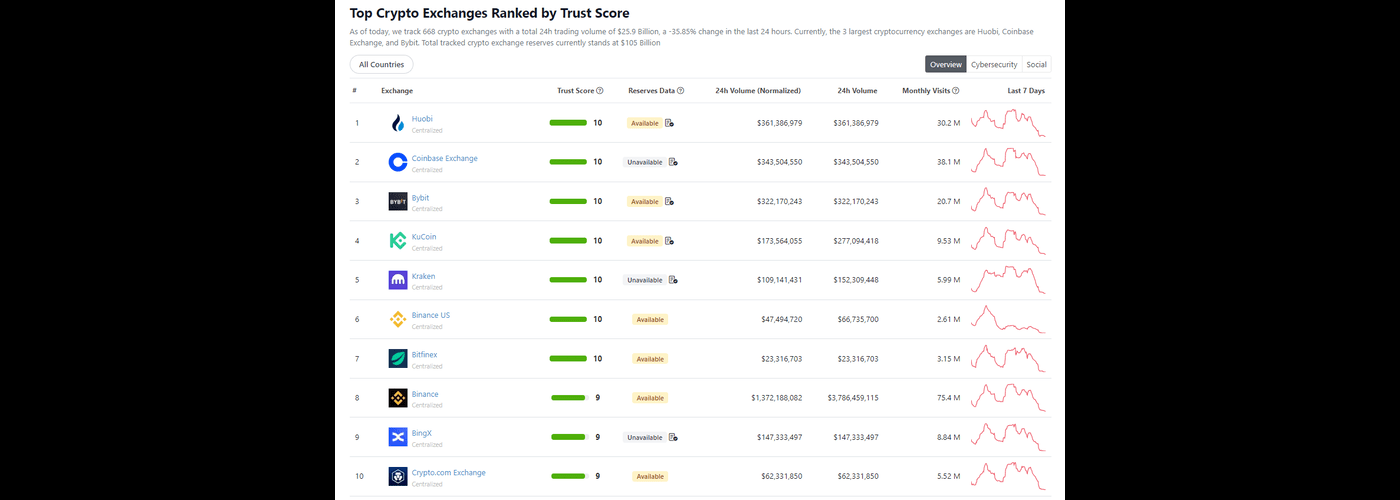

How many CEX exchanges exist?

Today, the crypto market offers a huge number of centralized trading platforms. All of them are trying to provide the most diverse service and options, which are not similar to the competitors. According to the analytical portal Coingecko, there are more than 660 CEX crypto exchanges. The largest are Huobi, Coinbase, Bybit, KuCoin, Kraken, Binance, etc.

Pros of CEX

What are the benefits of centralized platforms?

- The first advantage would be accessibility and ease of use

Almost everyone in the world has several centralized crypto exchanges to choose from. Depending on the user's goals, one can choose the right service and services. The supply of exchanges in the country depends on the internal regulation of the industry, the existence of a license for the exchange, and legal restrictions. But even so, the choice remains sufficient. The ease of use of CEX is much greater than that of DEX exchanges. You can just go to the site and intuitively understand the use. For DEX exchanges, it is not so simple; in this case, you need some experience as a crypto investor.

- Variety of services

Centralized exchanges tend to offer more services to their customers. There are both direct exchanges in fiat, easy purchase of cryptocurrency, passive earnings, and so on.

- Feedback

Centralized platforms keep in touch with their customers. It's a simple 24/7 chat, technical support, and application instructions. The user does not feel alone.

Cons of CEX

- The first and main disadvantage is censorship

The user puts his assets in trust (if I may say so). Rapid withdrawal of funds depends on the exchange and its compliance with transparent standards. Investor loses their cryptocurrency with any system error, technical failure, or deliberate scam.

- Lack of privacy

One of the benefits of using cryptocurrency is anonymity. However, the need for CEX exchanges to follow KYC and AML rules completely destroys this advantage.

Decentralized cryptocurrency exchange

Definition of DEX

A Decentralized Exchange (DEX) is a special application for trading crypto-assets, which uses automatic execution of transactions using smart contracts. The principle of DEX is simple: users access the services of a decentralized exchange through a non-custodial wallet (such as MetaMask). The exchange does not need to hold users' assets. The investor himself does all management and storage.

How decentralized exchanges work

The protagonists of DEX exchanges are smart contracts. Thanks to these smart contracts, all transactions are performed automatically, and there is no need for a centralized management body.

How does DEX work? It's simple: go to any decentralized service. The first thing you will be asked to do: it is to connect your wallet. This is a standard procedure that replaces the authorization and verification in DEX. Once connected, you become a full-fledged user and can exchange, sell and buy tokens, the blockchain of which the exchange supports. You can also become a liquidity provider and receive a percentage of each transaction.

The evaluation and execution of transactions on the DEX exchange are not done through the order book but through the Automated Market Maker (AMM) service. It is a special protocol that evaluates all sell and buys contracts in real-time and gives the actual rate at the moment.

Popular services on decentralized crypto exchanges (DEX)

Typically, DEX exchanges do not provide as many services as CEX. The main functions remain to sell and buy and to exchange. However, many tokens that have not yet announced an official listing are available for exchange on DEX, which is the hottest offer in the cryptocurrency market.

How many DEX exchanges exist?

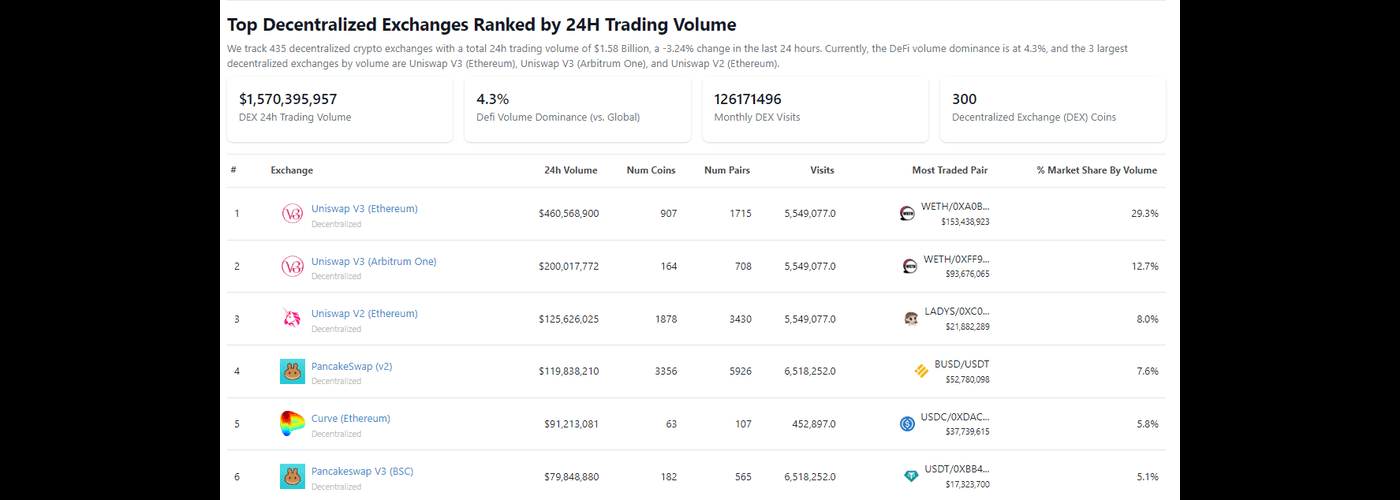

At the time of publication of this article, the Coingecko portal claimed more than 600 decentralized trading venues. Daily trading volume was $1,570,395,957.

Pros of DEX

- Security of assets

The main advantage of DEX exchanges I, of course, the investor's autonomy. The user's funds are in his crypto wallet, no centralized authority or third-party issuer can block them. In this way, the investor ensures himself from the bankruptcy of the centralized platform.

- Data Security

With DEX, there is no need for complete verification. Of course, some modern decentralized exchanges ask for proof of identity, but still, DEX is not as biased. And that means that not much information is collected, and user data can't be compromised.

- Variety of tokens

DEX exchanges offer the latest market tokens for trading. The user of decentralized exchanges can earn more on the newer ones.

Cons of DEX

- Difficulty for newcomers

Using a decentralized exchange should start with learning the blockchain structure, creating a non-custodial wallet account, etc. For a novice investor, this is a complicated process. Therefore, decentralized exchanges are not suitable for this type of investor.

- Liquidity Failures

DEX liquidity providers are the same users. Therefore, there may be a liquidity dip when, for whatever reason, there are not enough assets to exchange.

How to choose the right exchange in Thailand?

When choosing an exchange for a Thai citizen, of course, it is necessary to consider the territorial factor. What exchanges are available for a resident of Thailand? Are there no sanctions on the use? Is this or that cryptocurrency service legal in Thailand? These are just some of the common questions.

There are also individual ones: do you need to withdraw into fiat in Thailand? Does the user want to use passive income? Credit funds?

There are many such questions. Both DEX and CEX should have their answers. So, before choosing exchanges to work in Thailand, we advise you to understand: what exactly you need.

Conclusion

Which way to go: CEX or DEX? How can this question be answered? There are too many individual characteristics of each client. All investors have to choose for themselves. What are the user's goals? What service should be used? Is there enough experience? There could be dozens of such questions. And only by answering each one on its own will it be possible to make a choice.

Everyone chooses for himself which platform will be better. However, we recommend that you still pay attention to the EXEX exchange. This is a classic CEX exchange, which has serious tools to help you trade in addition to these advantages! A large number of indicators, automatic closing of a deal, the coolest RSI indicator (tells you when to open/close a deal), and other others, as well as a demo balance of $1000 and x500 leverage - only a tiny part of what will allow even a beginner to start trading! Join now!