What is shorting?

Description

Shorting is the trading of valuable assets (shares, currency pairs, cryptocurrencies), which is aimed at gaining profit from the falling value of the asset.

Have you ever seen the famous Hollywood movie The Big Short? It's a picture based on real events on the eve of the mortgage financial crisis in the U.S. in 2007-2008. The plot revolves around the prediction of a decline in the U.S. mortgage market and the competent prediction of this event. As a result, investors make a profit even at falling rates, i.e., to trade in shorts.

What is shorting in cryptocurrency?

Shorting is the trading of valuable assets (shares, currency pairs, cryptocurrencies), which is aimed at gaining profit from the falling value of the asset. That is, traders who trade shorts are not set up to profit from the rise in value. On the contrary, their earnings are based on the possibility of detecting a decrease in the value of the assets.

How to use short trading?

For example, you want to make money on Bitcoin falling in value. Let's say that on the eve of Jerome Powell's speech and the Federal Reserve's meeting, the value of fundamental assets: S&P500, USD, and Bitcoin is subject to high volatility. You see that such news could have a negative impact on the market, and you choose to trade short. How do you make money on this?

Let's say the Bitcoin exchange rate is $25,000 at the moment. Based on technical analysis, BTC will fall to $23,000. You sell your Bitcoin at $25,000 and buy back during the drawdown at $23,000, thereby earning $2,000.

It's the simplest short trading strategy. But traders often resort to a more complex scheme using leverage instruments. This term means funds attracted for trading concerning the total volume of funds the trader trades. Leverage increases the trader's income: by x5, x10, and even x500 times (like at our exchange EXEX).

Using leverage in short trading is justified. With this strategy, the trader can increase his initial funds to buy an asset (in our example, Bitcoin) in a larger volume. The trader borrows funds from the trading platform (cryptocurrency exchange) to buy more of the asset and sell it on the open market at the current price. The trader then waits for the rate to fall to buy back the same amount of funds borrowed from the broker. The trader keeps the profit generated by the price changes, except for the exchange commission - the earnings of short trading.

What are the risks of short trading?

Like all types of trading, short trading has its risks. The major ones include forecasting errors of price decrease. In this case, the rate will not decrease, on the contrary, it will show growth. The trader will be forced to compensate the borrowed sum with his own funds. How does it happen?

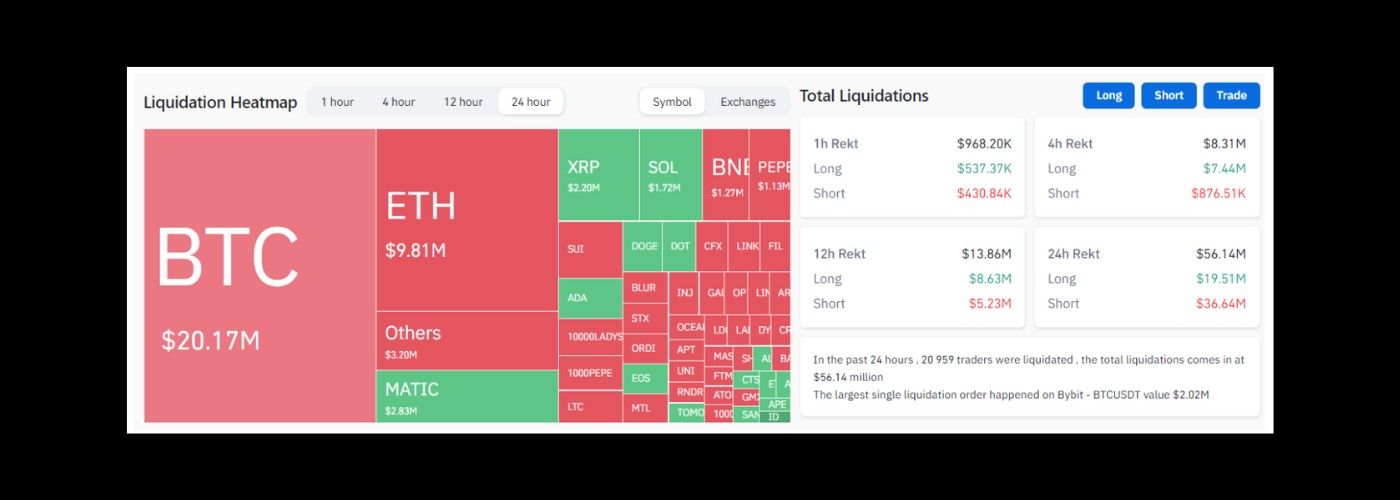

Suppose the asset's price movement doesn't meet the trader's expectations, and the price moves in the opposite direction, according to the trading rules. In that case, a margin call occurs - the process of automatic liquidation of the trader's position, consisting of equity and borrowed funds. In this case, the exchange automatically returns the loan amount with the margin (the amount of commission) to the lender. And the trader bears the losses at his own expense. On the active market, the liquidation value of all traders is one of the indicators of criticality and sharpness of trend movements. For example, when writing this article, 20 930 traders were liquidated in the last 24 hours, and the total sum of liquidations was $56.08 million. The largest liquidation order occurred on Bybit - the value of BTCUSDT was $2.02 million. By shares of liquidations: the leader was Bitcoin - $20.17 M, Ethereum - $9.81 M, and other cryptocurrencies - $3.2 M.

The trader may not wait for the moment when his short trade will automatically close at a loss. It is possible to close an unsuccessful trade manually to minimize losses. Or use Stop Loss limit trades (with predetermined parameters of loss and profit on an open trade).

Who are the bears?

Traders who trade short positions are called bears. It's a common notion for financial market participants. All because of the specific behavior of the animal when meeting the enemy: bears strike back from the top down as if pressing the enemy to the bottom.

The opposite is the bulls. This is the name for growth trading, trading in a long position. Also, because of the animal behavior: the bull attacks his enemy by pushing his head from the bottom upwards. The same as the chart for growth: from the lowest price marks to the highest.

How to short on a cryptocurrency exchange?

A cryptocurrency exchange acts as a universal trading service provider for users. The unique service, information processing speed, accessibility, and around-the-clock market operation are ideal for trading.

The volatility of crypto coins is also a big plus. The value of cryptocurrency changes very dynamically, which is beneficial for both short trading and long trading. To start shorting cryptocurrencies, choose a profitable asset to open a trade. Use appropriate technical and fundamental analysis strategies to identify negative trends in the asset price.

Open a trade with borrowed funds or with your own investment volumes. Tip: Start with minimum amounts to understand the meaning of short trading and gain experience analyzing the market. Later, after your trial period is over, start trading.

The Pros of Cryptocurrency Short Trading in Thailand

Short trading is one of the key trading strategies on crypto exchanges in Thailand. The use of short trades brings numerous advantages for crypto investors. Let's look at the main advantages of short trading for Thai:

- short trading is profitable. It is a way to increase your crypto investment with the right approach to trading and sound financial analysis.

- it is psychological support for the trader. Trading is a highly stressful action and energy costs for many people. In addition, investors often fear the very situation when the rate of an asset decreases. Short trading in Thailand (and other countries) allows you to take cyclical fluctuations in the market with greater ease.

- Short trading allows you to make money on market drawdowns. That is, there is no dependence on a growth or decline cycle. In any case, the investor from Thailand can make a profit.

Conclusion

Trading short is one way to make money in the cryptocurrency market. The volatility of this asset type allows for numerous trading opportunities. Investors use shorting to make profits, and that's a good thing.