How to trade cryptocurrency futures

Description

Experienced traders mostly use crypto futures trading. Futures trading basic is learned gradually because this tool is riskier than classic trading. You can learn future trading only through experience and fundamental market study. Our material will help with that.

What futures are

Futures are a financial tool allowing traders to make speculative profits on crypto trading without actually owning any cryptocurrencies.

The futures emerged in the crypto market in 2017, but they constitute a significant share of all crypto trades nowadays.

Benefits of crypto futures trading

Unlike spot trading, futures trading allows you to make a profit on the decrease in the currency rate. Also, leverages for futures are much higher. So, futures trading can be carried out based on two scenarios. For example, suppose you expect the cryptocurrency to grow. In that case, you open a long trading position by buying the asset or a short position by selling crypto because, according to your forecast, its price will fall.

Many of us have heard about those who love to go short trading. These people trade futures contracts and make speculative profits on short-term price decreases. Let’s say a trader presses the “Sell” button, borrowing money from a regulator and making a trade to sell an asset at a fixed price. Then, when the price falls, he buys an asset at a lower price, gives the borrowed funds back to the regulator, and the remaining funds become his profit.

Those who love to long are the futures traders who profit by buying crypto and then selling crypto to make a profit on the rate increase.

It’s you to decide what strategy to choose and what positions to use to make a profit – everything depends on you and your forecasts. The exchange allows you to open both types of positions, no matter what your qualification is – both options are available for beginners and experienced traders.

Trading futures for beginners: about leverage

What is leverage? Crypto futures trading leverage measures the trader’s funds compared to the total amount of funds (including borrowed funds) they use to trade.

Traders from all over the world look for the best conditions for futures trading. On the EXEX platform’s interface, you can see “x50”, “x75”, “x100,” and other marks located near the names of cryptocurrencies. They indicate the maximum amount of funds available to trade this crypto, compared with your funds – 50x more, 75x more, or 100x more.

So, if you have $50 and open a futures order with x100 leverage, you will trade $5000. For this sum of money, $50 is your funds, and $4950 is the funds you borrowed.

Suppose you want to trade with high leverage. In that case, you should also take into account the risks: the higher leverage is, the higher the risk of the liquidation of your position in case of a negative scenario of price movement. To avoid events like that, EXEX exchange opens all positions as stop-loss positions automatically (read “Risk Management on EXEX” to learn more)

How to learn future trading and open a long position on EXEX

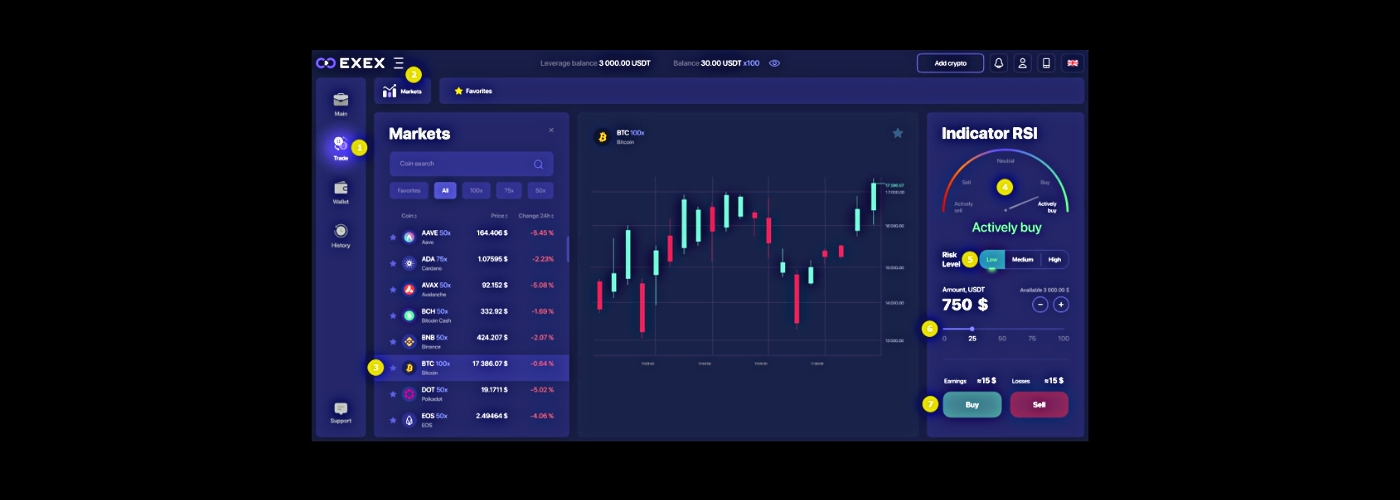

Futures trading basics on the EXEX exchange:

- Go to the “Trade” section (#1 in the picture).

- In the “Trade” tab, select “Markets” (#2 in the picture).

- Select a coin in the “Market” menu. Let’s say you want to trade Bitcoin. You have to find “BTC” on the list (#3 in the picture). After you have selected the cryptocurrency, you’ll see the BTC/USDT chart.

- On the right, you will see the RSI indicator and trading menu. The picture below shows that the indicator recommends buying the asset (#4 in the picture). To do so, select the risk level (#5 in the picture). The lower the risk is, the more likely it is that you will make a profit and won’t lose your funds if the trend works out in an unusual way.

- Select the sum you want to trade (#6 in the picture). Please note that you should specify the amount that includes your leverage in the “Amount, USDT” section. Thus, if you see 750 there, it means that your personal funds are 7.5 USDT.

- Press the “Buy” button to make a trade and buy Bitcoin. When a trade is made, it means that you have opened a long position.

When the price reaches the automatically set level, your position will be closed, and you’ll receive profit. Also, your Long position can be closed before the mentioned price level is reached – it’s enough to press the “Sell” button. In this case, you will close the trade and sell the asset at the market price.

How to open a short position on EXEX

To make trading short futures, or, in other words, to sell Bitcoin, you should follow the same steps as when you open a long position, the only differences are:

- The RSI widget indicator’s arrow will point to “Sell actively” or “Sell.”

- You have to press the “Sell” button to open a Short position.

- You can close your Short position before the price reaches the automatically set level – press the “Buy” button, and you’ll close the trade by buying the asset at the market price.

About Profit

It’s simple. Profit is literally your profit (#1 in the picture). Thus, in the picture below, you can see an open Short position that shows profit growth because the asset’s price fell below its level at the moment when the position was open. To close the position before Take-Profit works out, you can press the “Buy” button and get 15 USDT of profit.

Cryptocurrency futures trading in the Kingdom of Thailand

Futures can be traded by both professional participants in the Thai cryptocurrency market and by private investors by turning to a crypto futures trading service provider in Pattaya, Bangkok, Nonthaburi, or even Pak Kret. There are several strategies for trading futures, depending on the objectives that the trader is pursuing. Long trading and short trading, depending on which one the resident of Thailand chooses and what cycles of value movement are going on in the market.

Of course, for crypto futures trading leverage, one has to follow a risk management and trading planning strategy, whether you're in Phuket or Bangkok as a trader.

That said, you can learn future trading fairly quickly by using EXEX exchange tools and your own trading strategy.

Conclusion

Cryptocurrency futures on EXEX are a convenient and well-thought-out tool for making a profit. Here, a trader can build a truly successful trading strategy – the platform offers a unique combination of resources and mechanics – a user-friendly interface, indicator tips, and a balanced risk system with take-profit and stop-loss levels.

You should remember that the cryptocurrency market is very volatile, sometimes, classic technical analysis is helpless. Consequently, no indicator can guarantee 100% accurate results and provide perfectly accurate forecasts. EXEX reminds you that you shouldn’t consider the indicator’s signals as financial advice from EXEX.com.

Always analyze various market factors, take into account all suitable data and use it – newsbreaks, classic technical analysis, signals of indicators.

We wish you successful trading on EXEX!