Options trading: how not to burn out? Ultimate guide

Description

Everything you need to know about options trading. Options trading tips, benefits, and risks for beginners and experts

Options trading: how to avoid fold-up?

Options trading is a valuable tool, especially for the volatile cryptocurrency market. With this type of trading, an investor can hedge the risk that his stocks or cryptocurrency will go in a different direction than he would like it to and make a profit no matter which way the markets go.

Options trading is a common way for professionals and newcomers to the trading market to make money. But how not to lose money? How to save your strategy and earn money? Here is the options trading guide from EXEX.

What is the definition of Options Trading?

What are options trading and option meaning? It is a special type of trading contract, which states the right of a bidder (buyer) to buy or sell an underlying asset (cryptocurrency, tokenized shares, securities) at a specified period and price. This is one of the most popular trading tools for traders.

It's important to remember that an option is a right, not an obligation, to buy an asset. This is the main difference between options and futures.

Private investors use the option for short-term transactions and speculation, which brings a high potential yield with limited losses (the loss can only be the amount of the option premium). Options are not tied to market activity and the trend that is dominating at the time. You can profit from both rising and falling assets.

How to start options trading? To begin with, we need to know a little bit of the basics and terminology of options trading.

The underlying asset is used for trading an option (cryptocurrency, stock market and securities, commodities, and more).

Exercise price (strike) is the price to buy or sell the underlying asset, which is written in the option contract and fixed in it on the contract date.

The expiration date is when the option contract expires (week, month, or quarter).

Trader's premium - is a monetary reward received by the trader-seller of the option at the end of closing of the deal.

The option buyer is the one who pays the premium to the seller and gets the right (but not the obligation) to buy or sell the asset.

The option Seller is the one who receives the trader's premium for the option and is obliged to execute the contract at the request of the option buyer at the predetermined term.

There are two types of trading options: Call Options and Put Options.

What are trading Call Options?

Call Options is a trading agreement for a long position (long) to profit from the growth of the underlying asset in the future. It allows the buyer of an option to earn income from an increase in the underlying asset's price. The trader gets the right to buy the asset at a fixed price on or before a predetermined date, and the seller agrees to sell the asset upon the occurrence of specified conditions. If the underlying asset's price exceeds the option's target price (strike), the buyer can put the option to execution and receive a return.

What are trading Put Options?

Put Options are for the buyer of the underlying asset to make a profit from a price decrease. The buyer sells the asset at a fixed price on the predetermined date. The seller is obliged to take delivery of the underlying asset if the buyer requests to exercise the option. The trader or investor takes a short position - short if he acquires this option. That is, he bets on the fall of the asset to make money on this.

What other options are there? There are quite a few different kinds and types of options. For example, European and American options depend on the rules of execution and the specific mechanics of the option from the time of purchase to the day of the contract.

So, American options can be presented for execution on any trading day, i.e., from the moment of purchase until the day of the contract, while European options can be presented for execution only on the day of the contract.

Different options also depend on the expiration term (weekly, monthly, quarterly). As well as by the method of payment (margined and premium).

What is trading Options Expiration?

Options Expiration is time option expiration, terminating the circulation of futures contracts on the securities market, which entails fulfilling pre-specified obligations. That is, this action is tied to a time.

Depending on the type of option (marginalized or premium), the types of settlement between the parties differ. For example, for a premium option, the premium is settled immediately and paid by the buyer to the seller. For a margin option, there is an interim settlement, and at the time of expiry, the parties simply transfer each other the balance.

Can I change the expiry time of my options? Yes, it is quite possible. So, first of all: is it possible to extend the expiry time? This option is not always available, but still possible. And this service is paid, most often as a percentage of the transaction. Extending the expiry time of the options helps to reduce the losses and ensure the participant of the transaction against a negative result and is used if there is a real possibility to wait for the profit in the future period.

Second: Expiration can occur ahead of time if the option holder, due to any circumstances and reasons, decides to close the contract before the expiration date.

What is an Options Chain?

There is another definition: options matrix. These are all available option contracts of different types, both put and call, for the selected underlying asset (cryptocurrency, security). This is a kind of statistic on all open option trades within a certain time.

Traders use this statistic for analytics, it is the most understandable and natural type of information presentation. Most often, the chain reflection of contracts is used when all options are lined up individually. This will allow you to scan activity in the selected asset, open interest, and price changes over time.

The options matrix helps every trader to determine quickly and affordably the mood of the market to price levels, growth or decline, and the most significant accumulations of liquidity.

Examples of options on different market movements

Let's look at an example of a bullish call option:

The following conditions are given: if the price of the underlying asset (for example, Bitcoin) is $20,000, buying one Bitcoin call would be $22,000 and paying a premium commission of $650. One bullish call option can be sold at a price of $28,000 and a premium fee of $250.

The value of the entire trade would be $400 ($650-$250).

The breakeven point of the deal comes at a price point of $22,400 ($22,000+$400). The maximum profit that can be obtained by the trader will be $5600 and will be obtained in case the base asset reaches the maximum price of $28,000 ($28,000 - $22,000 - $400).

It will be time for the trader to lose a share of the portfolio if the price of the underlying asset drops below $22,000. In this case, both calls will execute without profit or loss, and the trader will lose a $400 commission fee.

Let's look at an example of a bearish put option.

This mirrors the situation with the previous example.

A bearish put option mirrors a bullish call option and is designed for a market with a decline in the price of the underlying assets.

For example, at an underlying price of the underlying asset (the same Bitcoin) of $20,000, one BTC put the purchase for $19,000 would require an additional $500 commission expense.

Selling that put contract at an underlying asset price of $17,000 would pay a $250 premium.

The cost of the transaction would then be $250 ($600 - $250).

The break-even point will occur when the price of the underlying asset reaches $18,500 ($19,000 - $500), and the maximum profit of $1500 when the price reaches $17,000 ($19,000 - $17,000 - $500).

Options Greeks definition

Options are still a high-risk financial instrument, so analytics in this area is of great importance. Factors that show the option's sensitivity to possible volatility and price fluctuations are called "Greeks" - after the Greek alphabet letters: theata, vega, delta, and gamma. Each letter represents a new type of risk.

What is theata? Theta is the decline in the value of an option over some time.

Delta is the effect of the underlying asset's price on the change (up or down) in the option contract price or premium.

Vega is the risk of changes in the projected volatility of the underlying asset. Gamma is the rate of change in the underlying price or the change in the delta risk over time.

Technical Analysis and options trading: how does it work?

Many technical indicators are used to predict the volatility and price movements of various assets. There is also a type of indicator which are used to analyze the price of options.

To use technical indicators in options trading, you need to consider the characteristics of this type of contract. For example, traders of simple cryptocurrency or securities are not limited in time and can adjust their analytics. However, options trading must take into account the time constraints of the contract. The following contract price movement indicators are most commonly used:

-

Put and Call Options Ratio (PCR). It is used to analyze the overall market mood.

-

Bollinger Bands. The volatility indicator is the change in the current deviation of option price from a simple moving average.

-

Relative Strength Index (RSI). This is a technical indicator for comparing overbought option levels and oversold price levels.

-

Intraday Momentum Index (IMI). A high-frequency options index for intraday trading is also used to analyze overbought and oversold zone.

-

Open Interest (OI). Analysis of open contracts in options, which shows the direction of the emerging trend (upward or downward), as well as the strength of the future trend.

Top 3 Choices for Options Strategies

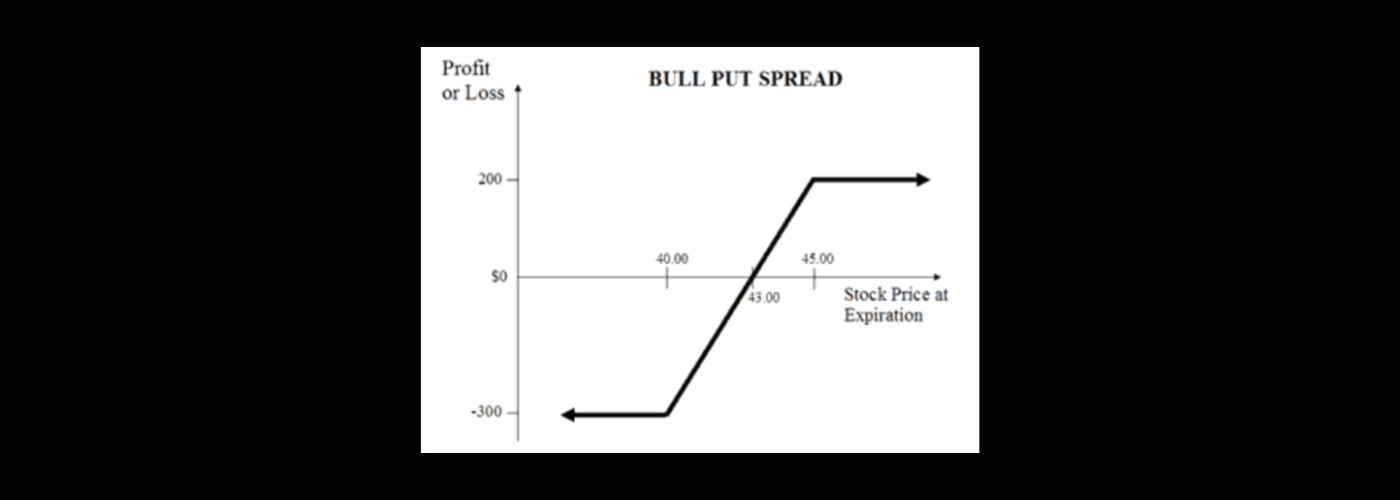

Every trader faces the difficulty of choosing a strategic approach to options trading. How to start options trading? Of course, to use the clearest and most reliable strategy. For example, a bull call spread.

This is a strategy in which the options trader buys call options at a lower strike price and sells the same amount but at a higher price. All contracts have the same expiration date. Suitable for an optimistic market movement scenario when the investor is confident of a gradual increase in the price of the underlying asset.

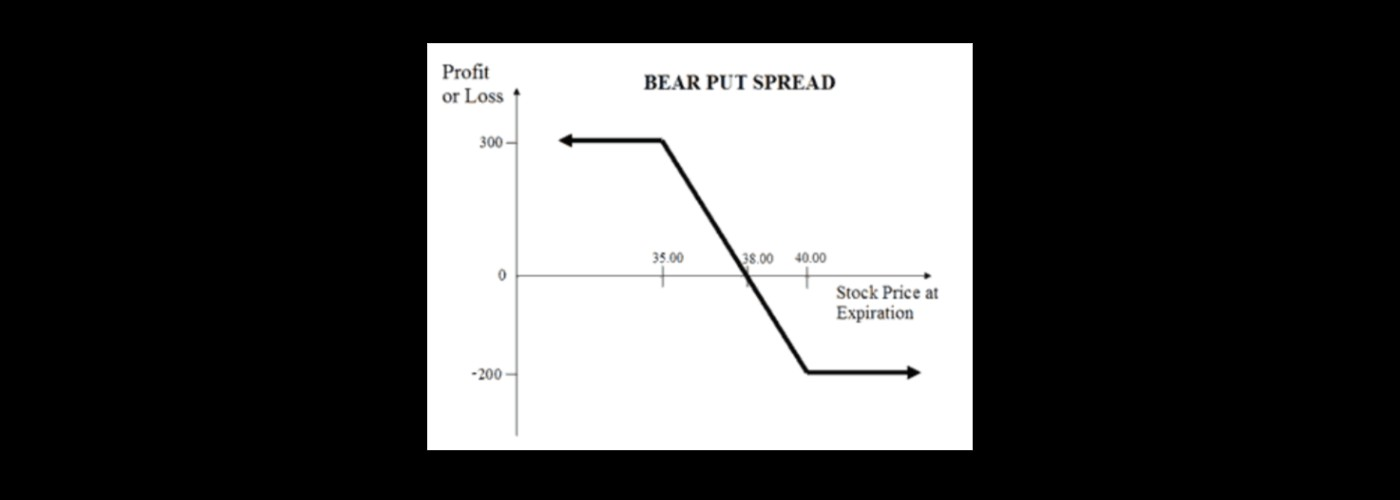

Mirroring the bullish call spread strategy, the bearish put spread strategy. The trader makes simultaneous purchases and sales with the benefit of putting options on the same underlying asset and expiration date. It is used when bearish sentiment on the price movement of the underlying asset.

Long Strangle is another strategy. It is used to catch the intensive movement of the price of the underlying asset in cases where the direction of the future movement is unknown. The investor buys a call and puts options with different strike prices at the same time and for the same asset and expiration date.

Benefits of trading options on EXEX

The benefits of trading options for investors are undeniable and they bring additional income opportunities to every trader. Using trading options brings a guaranteed passive income in the form of an option premium for the trader. This is one of the safe ways to trade assets.

Also, trading options is an opportunity to refuse from buying an underlying asset at an unprofitable price. The market situation can change at a high rate and not always the risk management in direct asset trading helps to balance losses and eliminate financial hazards.

Another advantage is that the investor chooses the future price of the transaction with an underlying asset (cryptocurrency, securities) independently, based on the strategy chosen for trading and the financial and economic state of the market.

What Is Theta in Trading?

It would seem to be a completely irrelevant Latin term for the topic of options trading. However, it is not. As we defined above, it is one of the types of risks that are lumped together under the general term "Greeks".

So What Is Theta Bottom Line? It is a general trend of the rate of decline in the value of an option, expressed in a period. Another term that applies is option time decay, which is the natural decline in contract value in the option over time, with all other factors unchanged.

The value of the option for the seller and for the buyer

Since the option's value changes downward over time, you need to consider this risk. And also correlate with the possibility of early redemption of the contract by buying back the underlying asset about the strike price, which is set at the time the contract is created.

The Theata changes over time, so the impact of this indicator will be different for long and short-term contracts. The Theta is always negative for long options and becomes zero when the term expires. We can also say that Theata is of more interest to option buyers than to option sellers. Over time, the sellers lose in value and the buyers get better entry deals.

Conclusion

Options trading is one of the most interesting and promising types of trading. It is available for new investors and experienced traders alike, the main thing is to keep your trading strategy and use your experience.