What Is Tether (USDT)?

Description

Definition of Tether, and what is a USDT coin? This is the world's first cryptocurrency that has a stable exchange rate peg to the U.S. dollar, which increases the USDT value of the cryptocurrency for the entire market and simplifies the circulation of digital assets.

Tether (USDT) is the world's first cryptocurrency linked to the rate of a fiat currency – the US dollar. This is why Tether is called a stablecoin.

What is USDT?

This is a ticker symbol of the world's first cryptocurrency with a stable rate of Tether (USDT).

A history of Tether (USDT)

In 2012, J. R. Willet, a programmer, developed the technology to create new cryptocurrencies based on Bitcoin. Thus, in 2013, they released Mastercoin – a Bitcoin-based cryptocurrency- and developed the similarly-named protocol, Mastercoin – and started the Mastercoin Foundation company. Later, their names were changed to Omni layer protocol and Omni Foundation. The chairman of the Bitcoin Foundation, Brock Pierce, and the leading blockchain programmer, Craig Sellars, took the main positions in a new project.

In 2014, Reeve Collins, a famous advertising and marketing entrepreneur, joined this star tandem, thus transforming it into a trio. The team launched the Realcoin project and opened its headquarters in Santa Monica, USA. In October 2014, the new company released Realcoin – the token based on Bitcoin and the Omni layer protocol.

A month later, in November 2014, the team decided to rebrand Realcoin. Its new name was Tether. The main goal of this tactic was to prevent people from associating Tether with Altcoins because the trio was mainly aimed at creating the world's first stablecoin.

What does USDT mean?

Stablecoins is a universal name for the cryptocurrencies secured by fiat currencies or resources such as for example, gold or oil. This wording also applies to the defined Tether.

After several years and stages of development, Tether became a stable cryptocurrency with a 1:1 relationship with USD. It is backed by a real fiat asset and other financial assets of Tether Limited, including the loans provided by the company's sub-companies.

There are more than a dozen blockchains on which the stablecoin issuer Tether has issued its coin. The most popular are USDT ERC20 and USDT TRC20.

Tether meaning and who needs USDT

Tether is a stable cryptocurrency linked to one of the most popular world currencies – the US dollar. Investors and traders say that the main benefit of USDT is that it's convenient for making transactions: this cryptocurrency enjoys all the benefits of regular fiat currencies, including the main one: extremely low volatility level.

Making payments in USDT is profitable from the point of view of transaction transparency. Thus, the Tether company (cryptocurrency creators) monitors the volume of funds in circulation and compares the amount of issued tokens and the amount of USDT on the users' accounts with the amount of real funds in the storages and on the accounts of the company. These funds ensure a proper trading balance for the cryptocurrency.

Trading with the help of USDT is a reasonable and wise capital development strategy. You keep your investments safe thanks to the stable Tether/USD rate, thus not only staying aware of everything that happens in the market but also being able to improve your trading tactics more sophisticatedly. This cryptocurrency's rate is a kind of guarantor that ensures the functioning of all types of trading on crypto exchanges.

The USDT meaning for the crypto economy: benefits of stablecoin

Here's a brief overview of the main benefits of Tether:

- affordable and easy-to-buy;

- paired with all cryptocurrencies;

- a simple way to make a deposit;

- backed by real financial assets guaranteed by the issuing company - Tether Limited;

- high transaction speed;

- stable rate: the cryptocurrency is pegged in a 1:1 ratio with the US dollar;

- reserve fund;

- can be used as a payment method in many countries;

- USDT is the most widespread and popular stablecoin in the world.

Where to store and how to transfer USDT

Cryptocurrency wallets – both hot and cold – are the most convenient method to store USDT. Hot wallets are wallets located on special crypto services. Thus, EXEX allows its clients to store cryptocurrency and deposit funds to the user's unique crypto wallet on the platform.

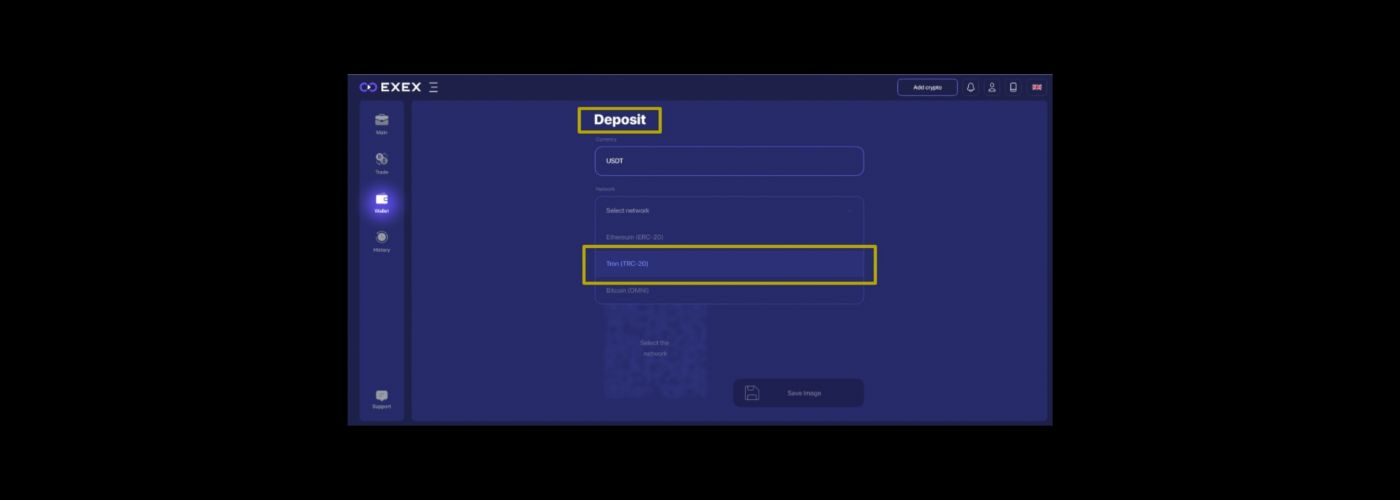

Depositing USDT to your EXEX wallet

Important information: when you deposit/withdraw USDT to/from EXEX and select the network to transfer USDT from one wallet to another wallet, select the wallet address based on the network's name.

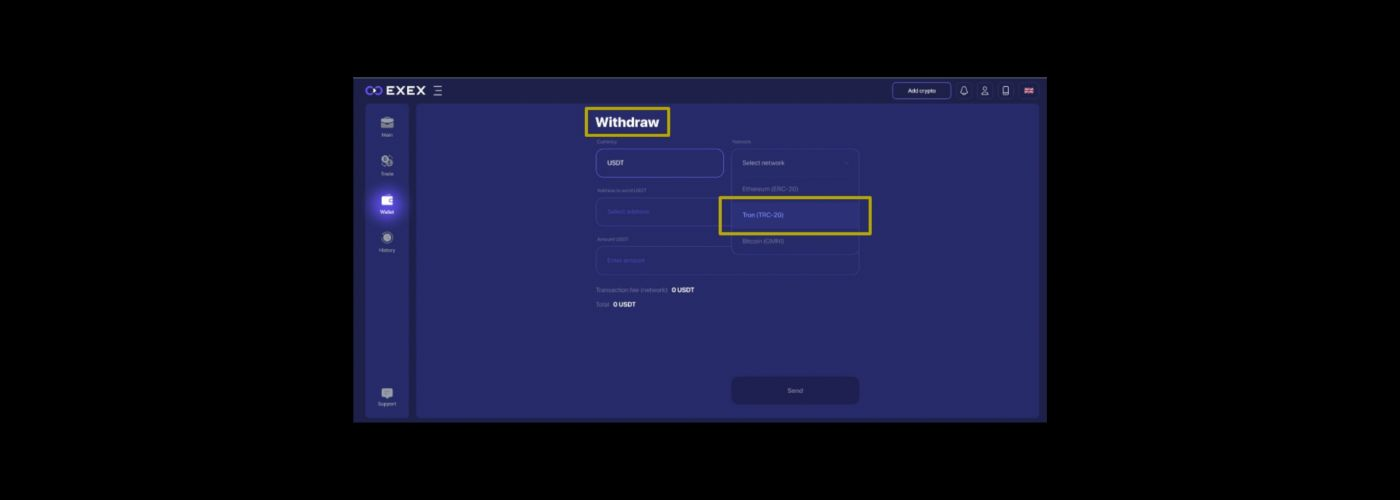

Withdrawing USDT from your EXEX wallet

Please note that you need to use a network that makes cryptocurrency transactions to deposit funds to your EXEX wallets and to withdraw funds to an external wallet. The platform offers Ethereum (ERC-20), Tron (TRC-20), and Bitcoin (OMNI) wallets. Each of them has its own characteristics; also, they differ in terms of transaction time, fees, and the number of network confirmations.

Thus, if you want to transfer USDT via the Tron (TRC-20) network, make sure that the sender's wallet address and the recipient's wallet address are linked to the Tron (TRC-20) network. Otherwise, your funds will be irretrievably lost if you try to make a transaction because, if you select the wrong address for a recipient, in fact, you transfer your funds to nowhere.

Conclusion

Tether (USDT) definition: is the world's most reliable stablecoin that ensures the biggest part of trade circulations of all crypto exchanges in general. Tether capitalization exceeds $80 billion, trailing only Bitcoin and Ethereum.

Reliability and asset backing are not the only benefits of Tether. Its global popularity among traders and as a payment method isn't the final stage of developing this unique token.

Choosing USDT as the main currency in pairs with other cryptocurrencies allows traders to enjoy the transparency of transactions, understandable fees, and an ability to improve their trading strategies.

EXEX chooses only the best options for its clients, and this is why Tether became the main crypto resident of the platform and is chosen for making transparent and protected trades.